What is the Thermoplastic Elastomers Market Size?

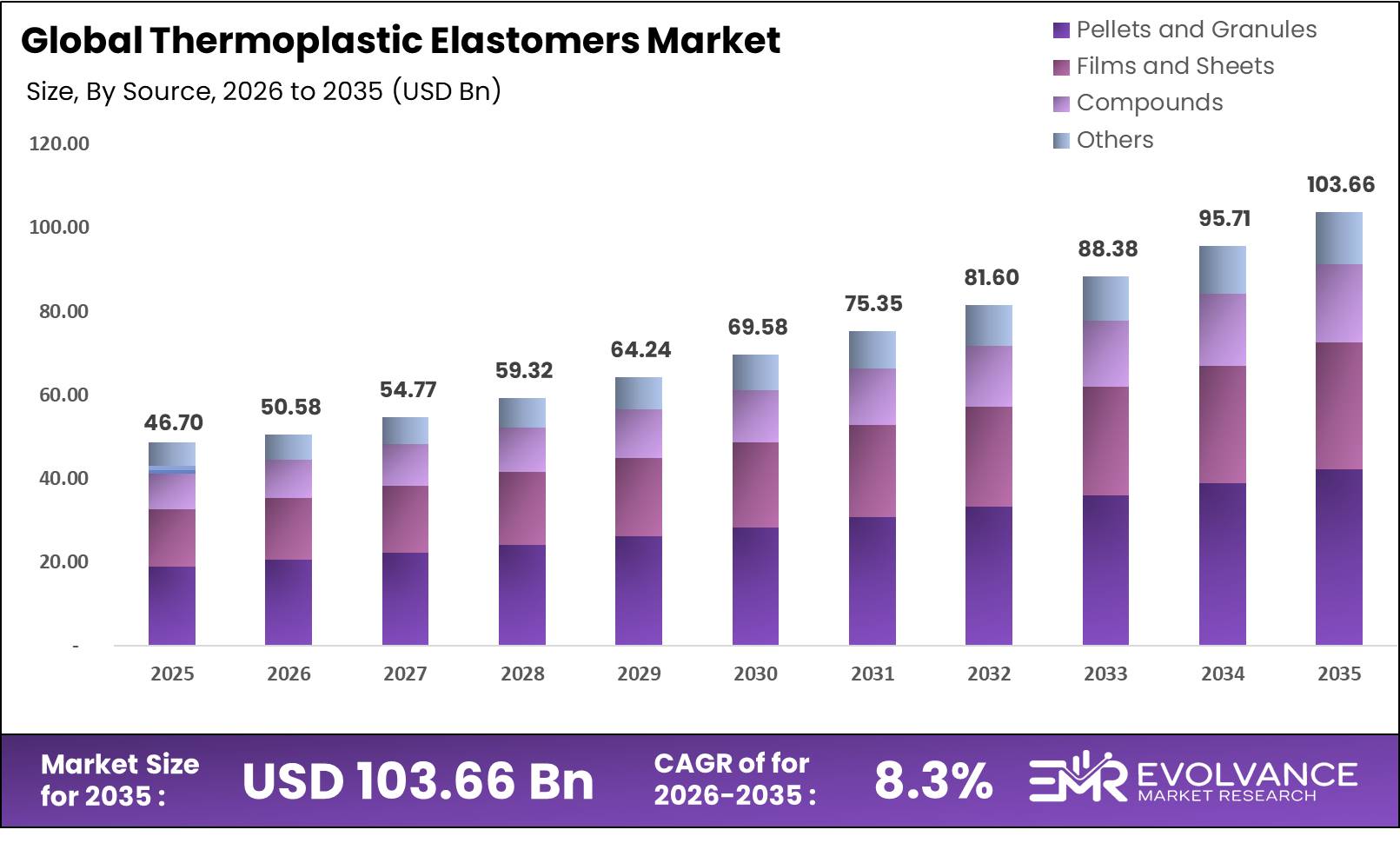

Global Thermoplastic Elastomers Market size is expected to be worth around USD 103.66 Billion by 2035 from USD 46.70 Billion in 2025, growing at a CAGR of 8.3% during the forecast period 2026 to 2035. This growth stems from rising use in auto lightweighting programs, medical device making, and consumer electronics. Firms shift from rigid plastics to flexible TPE materials for better product design and comfort.

Key Takeaways

- The Global Thermoplastic Elastomers Market valued at USD 46.70 Billion in 2025, projected to reach USD 103.66 Billion by 2035, at 8.3% CAGR from 2026 to 2035.

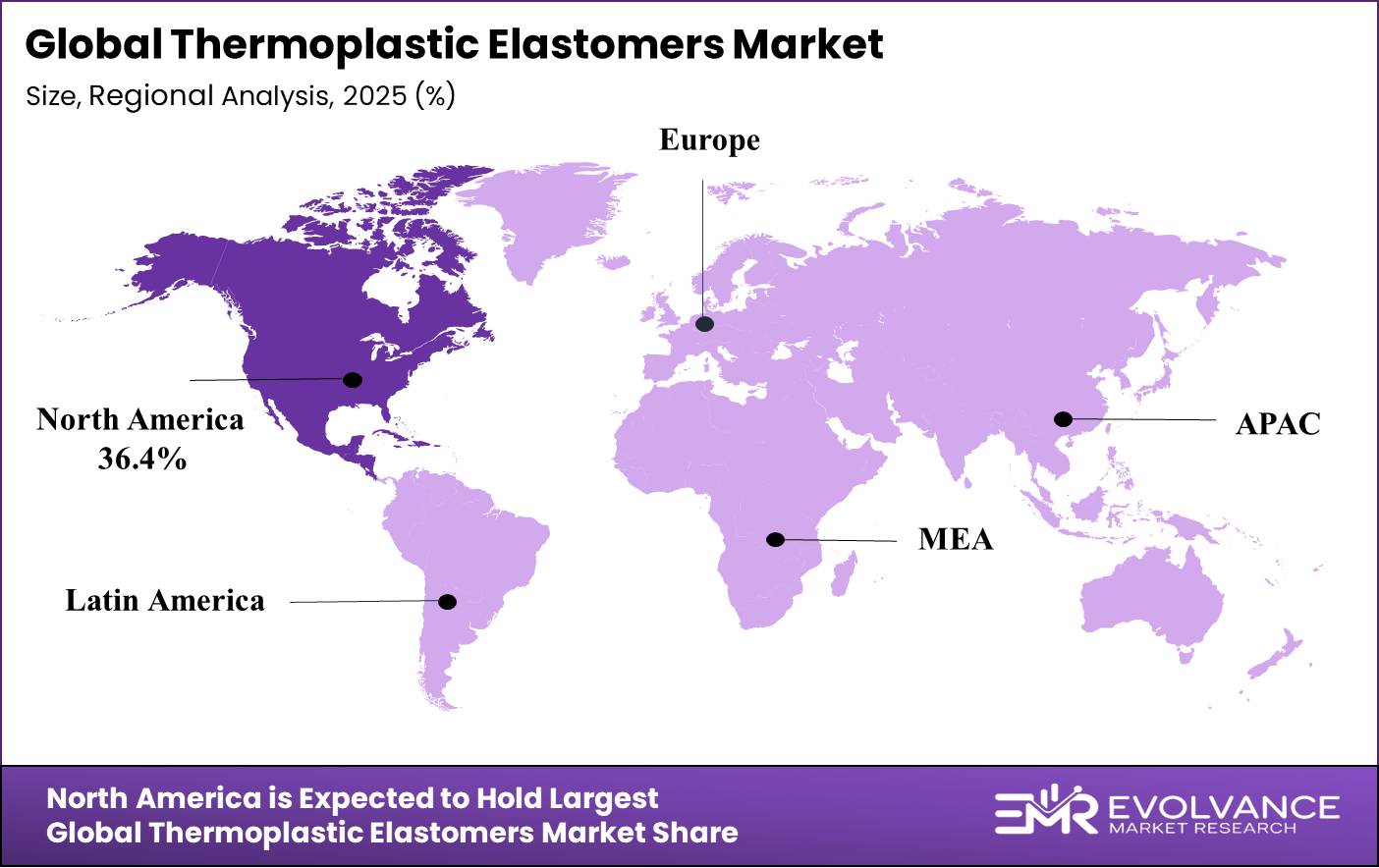

- North America dominates with 36.4% share, valued at USD 16.9 Billion.

- TPE-S (Styrenic Block Copolymers) dominates by type segment with 30.4% market share.

- Pellets and Granules form leads with 38.9% share.

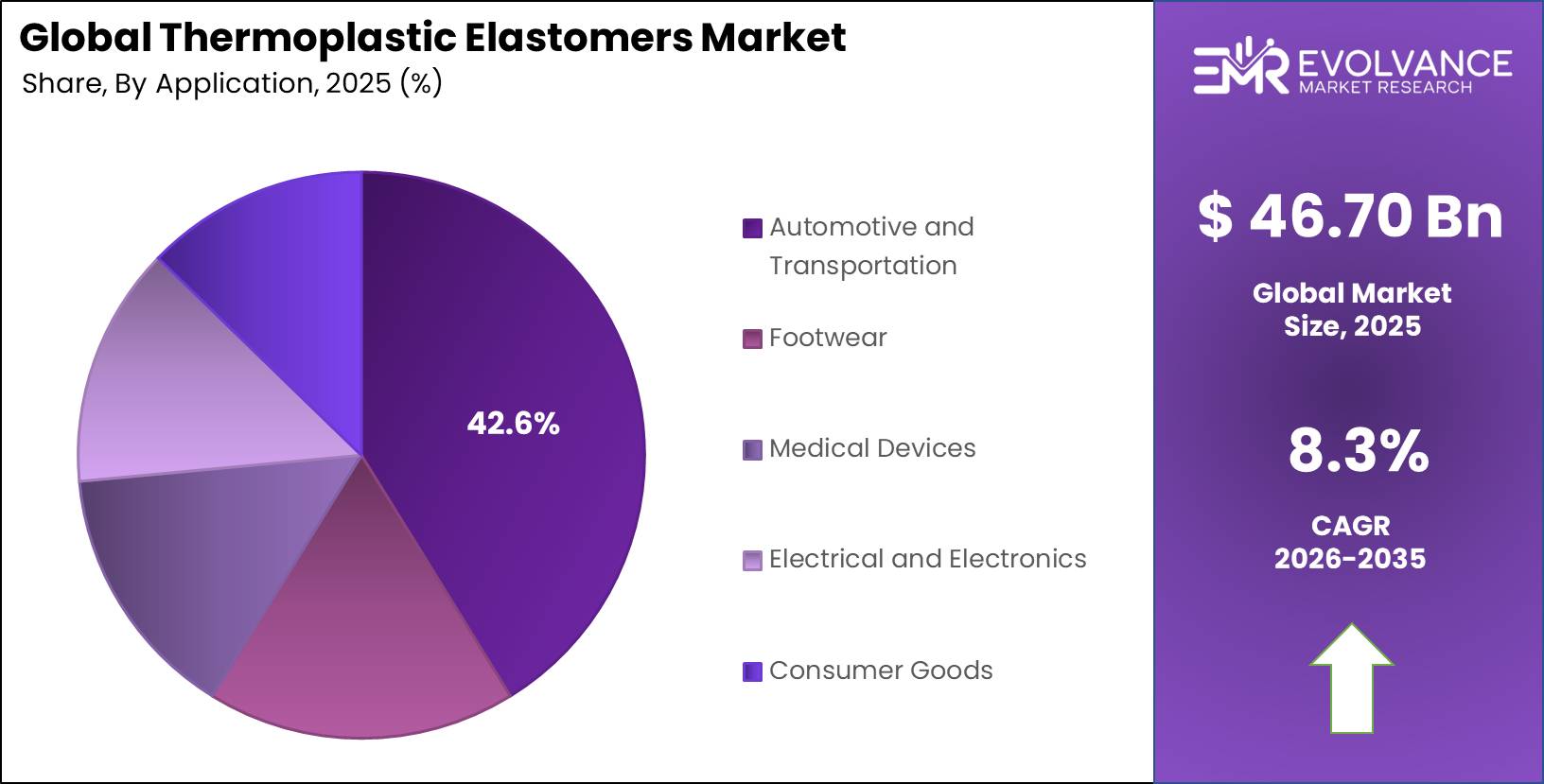

- Automotive and Transportation application holds 42.6% market share.

Market Overview

Thermoplastic elastomers blend the processing ease of plastics with the flexible traits of rubber. These materials can be melted, shaped, and recycled like standard plastics while keeping soft-touch and elastic features. TPEs serve auto parts, medical tools, footwear, and consumer goods across global markets.

The sector benefits from strong demand in vehicle making, where makers seek lighter parts to boost fuel savings. Medical device firms adopt TPEs for tubing, seals, and packaging that must meet strict safety rules. Consumer electronics brands use these materials in phone cases, cable covers, and wearable devices.

Auto firms drive major growth as they replace heavy metal and rigid plastic parts with flexible TPE components. These materials cut vehicle weight by 15 to 20 percent in select parts while keeping strength and durability. Electric vehicle makers now use TPEs for battery seals and cable systems.

Medical device making expands rapidly in aging markets across North America, Europe, and Asia Pacific regions. TPE materials offer biocompatible traits needed for surgical tools, drug delivery systems, and diagnostic equipment. These products can withstand repeated sterilization cycles without losing physical properties.

Construction and industrial sectors increase TPE use for sealing, insulation, and weatherproofing jobs. Building codes now require better energy efficiency, pushing demand for advanced sealing materials. TPEs resist UV light, extreme temps, and chemical exposure better than older rubber compounds.

Sustainability trends reshape material choices as firms seek recyclable options to meet environmental goals. TPEs can be reprocessed multiple times without major quality loss, unlike thermoset rubbers that cannot be melted. This circular economy advantage attracts brands committed to reducing plastic waste.

Innovation in bio-based TPE formulas creates new market openings as companies develop materials from plant oils and renewable sources. These green alternatives appeal to consumer goods makers facing pressure to lower carbon footprints. Research teams work on improving bio-TPE performance to match petroleum-based versions.

Emerging markets in Asia, Latin America, and Middle East regions show fast industrial growth and rising living standards. Local making of cars, electronics, and medical devices boosts TPE consumption. China and India lead regional demand due to large populations and expanding middle-class consumer bases.

By Type Analysis

TPE-S (Styrenic Block Copolymers) dominates with 30.4% due to cost efficiency and versatile processing.

In 2025, TPE-S (Styrenic Block Copolymers) held a dominant market position in the By Type segment of Thermoplastic Elastomers Market, with a 30.4% share. These materials blend styrene and butadiene blocks to create soft yet durable compounds used in grip handles, seals, and footwear. Makers prefer SBC materials for injection molding and extrusion due to lower processing temps and fast cycle times.

TPE-E (Olefinic/TPV) materials combine polypropylene with EPDM rubber through dynamic vulcanization during mixing. These compounds resist heat up to 140°C and serve auto seals, pipe gaskets, and outdoor applications. TPV grades offer better compression set resistance than standard TPE-O blends, making them ideal for long-term sealing jobs.

TPE-U (Polyurethane-Based) thermoplastic polyurethanes deliver exceptional tear strength and abrasion resistance for demanding uses. Shoe sole makers, industrial belt producers, and cable firms choose TPU for products needing flex fatigue resistance. These materials typically range above 80 Shore A hardness and handle repeated bending without cracking.

TPE-V (Vulcanizates) represent high-performance compounds of polypropylene and EPDM rubber that undergo vulcanization during compounding. They replace traditional EPDM rubber in auto seals and pipe seals where heat resistance to 120°C is required. Shore hardness values span from 45A to 45D across different grades.

By Form Analysis

Pellets and Granules dominates with 38.9% due to ease of handling in injection molding.

In 2025, Pellets and Granules held a dominant market position in the By Form segment of Thermoplastic Elastomers Market, with a 38.9% share. This form suits automated feeding systems in injection molding machines and extrusion lines used by auto parts makers. Pellet shapes ensure consistent material flow and reduce waste during processing compared to powder forms.

Films and Sheets serve packaging, medical wraps, and protective covering applications where thin, flexible barriers are needed. Converting firms thermoform TPE sheets into complex shapes for product packaging and medical device components. Film products offer good tear resistance and clarity for visual product displays.

Compounds represent pre-mixed formulas that blend TPE base polymers with fillers, colors, and performance additives. Molders buy ready-to-use compounds to skip in-house mixing steps and ensure batch-to-batch consistency. Custom compound suppliers create specialized grades for specific customer needs in electronics, medical, and industrial markets.

Others (Powder, Strips) include specialty forms for coating, adhesive, and textile applications where pellets cannot be used. Powder TPEs work in rotational molding and spray coating processes for irregular shapes. Strip forms suit profile extrusion for weather seals and edge trim applications.

By Application Analysis

Automotive and Transportation dominates with 42.6% due to lightweighting and design flexibility needs.

In 2025, Automotive and Transportation held a dominant market position in the By Application segment of Thermoplastic Elastomers Market, with a 42.6% share. Vehicle makers use TPEs for seals, gaskets, interior trim, and bumper components that reduce weight while keeping safety. Electric vehicle production drives new demand for battery pack seals and high-voltage cable insulation materials.

Footwear makers rely on TPE compounds for athletic shoe soles, casual footwear, and fashion boots requiring comfort and durability. These materials provide cushioning, slip resistance, and color options that appeal to sports brands and lifestyle companies. TPE shoe soles can be recycled more easily than traditional rubber vulcanizate products.

Medical Devices use biocompatible TPE grades for tubing, catheters, seals, and packaging that contact patients or drugs. These materials withstand sterilization through steam, gamma radiation, and chemical methods without degrading. Medical TPEs meet strict regulatory standards for cytotoxicity, extractables, and particle contamination set by health authorities.

Electrical and Electronics applications include cable insulation, connectors, phone cases, and wearable device bands needing soft-touch surfaces. TPE materials provide good electrical insulation while allowing design freedom for ergonomic product shapes. Consumer electronics brands prefer TPEs for overmolding onto rigid plastic housings to improve grip.

By End-Use Analysis

Automotive end-use dominates with 34.6% driven by regulatory fuel efficiency mandates.

In 2025, Automotive held a dominant market position in the By End-Use segment of Thermoplastic Elastomers Market, with a 34.6% share. Car makers face government rules requiring lower emissions and better fuel economy through vehicle weight cuts. TPE parts replace heavier metal and glass components in doors, windows, and interior systems without losing performance.

Healthcare and Medical end-use grows as hospitals and clinics expand services for aging populations in developed countries. Surgical tool makers, diagnostic equipment firms, and drug delivery device producers specify TPE materials for patient contact parts. Disposable medical products use TPEs to balance cost with needed safety and sterility features.

Industrial and Construction sectors deploy TPEs for seals, gaskets, hoses, and weatherproofing components in buildings and machinery. Construction firms choose TPE window seals and door gaskets that last decades in outdoor conditions. Industrial equipment makers use TPE hoses and belts that handle oils, chemicals, and temperature swings.

Electrical and Electronics manufacturing consumes TPEs for wire coating, power cords, and consumer device accessories sold globally. The rise of home automation, smart devices, and renewable energy systems boosts demand for flexible cable materials. TPE insulation resists abrasion better than PVC in applications with frequent flexing.

Market Segments Covered in the Report

By Type

- TPE-S (Styrenic Block Copolymers)

- TPE-E (Olefinic/TPV)

- TPE-A (Styrene-Based Alloys)

- TPE-U (Polyurethane-Based)

- TPE-V (Vulcanizates)

- TPE-O (Other/Hybrid Blends)

By Form

- Pellets and Granules

- Films and Sheets

- Compounds

- Others (Powder, Strips)

By Application

- Automotive and Transportation

- Seals and Gaskets

- Interior parts

- Bumpers and Trims

- Footwear

- Athletic shoes

- Casual footwear

- Medical Devices

- Tubing and catheters

- Medical packaging

- Electrical and Electronics

- Cable insulation

- Connectors and housing

- Consumer Goods

- Sporting goods

- Appliances

By End-Use

- Automotive

- Healthcare and Medical

- Industrial and Construction

- Electrical and Electronics

- Consumer Goods

- Packaging

- Others (Sports, Textile, etc.)

Thermoplastic Elastomers Market Regional Insights

North America Dominates the Thermoplastic Elastomers Market with a Market Share of 36.4%, Valued at USD 16.9 Billion

North America leads global TPE consumption due to advanced auto making, robust medical device sectors, and strong consumer goods industries. The US houses major vehicle assembly plants from Detroit Three automakers plus foreign brands operating southern factories. Canada contributes through auto parts suppliers and growing medical device making in Ontario and Quebec provinces that export worldwide.

Europe

European markets show steady TPE adoption driven by German auto excellence, French consumer goods makers, and UK medical innovation clusters. Strict EU environmental rules push firms toward recyclable TPE materials over traditional thermoset rubbers in packaging and construction. Eastern European countries attract TPE compounding plants serving regional auto assembly operations with lower labor costs.

Asia Pacific

Asia Pacific experiences fastest regional growth as China, India, and Southeast Asian nations expand industrial output and consumer spending. Chinese auto makers increase domestic EV production using TPE battery seals and interior components for growing middle class. India’s medical device making rises to serve large population while reducing import dependence on foreign suppliers.

Latin America

Latin American demand grows through Brazilian auto making, Mexican electronics assembly, and regional construction activity funded by infrastructure investments. Nearshoring trends bring more US and Asian firms to Mexico for TPE molding close to North American markets. Brazil develops bio-based TPE materials using local agricultural resources like sugarcane and vegetable oils.

Middle East & Africa

Middle East and Africa show emerging TPE consumption as GCC nations diversify economies beyond oil into making and construction sectors. Saudi Arabia and UAE invest in industrial parks attracting foreign TPE compounders and molders serving regional builders. South African auto parts makers supply local assembly plants and export to European markets needing cost-effective components.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Regulatory Landscape

Global TPE markets face evolving rules around food contact materials, medical device biocompatibility, and chemical substance registration under systems like EU REACH. Regulators require extensive testing data proving TPE safety for applications touching food, skin, or medical patients. Makers must validate that materials contain no harmful extractables or leachables above permitted limits set by health authorities.

Environmental rules in 2024 through 2026 push TPE producers toward lower carbon footprints and increased recycled content in compounds. California’s Proposition 65 and similar state laws require disclosure of chemicals linked to cancer or reproductive harm. Auto industry standards like ISO 16949 mandate quality systems ensuring consistent TPE part performance across production batches.

Medical TPE grades must meet FDA guidance, ISO 10993 biocompatibility standards, and USP Class VI testing protocols before clinical use. European Medical Device Regulation enacted in 2021 continues influencing TPE suppliers through stricter documentation and traceability rules. These regulations increase compliance costs but ensure patient safety and product reliability in healthcare applications.

Drivers

Accelerating Substitution of Conventional Rubber with Recyclable Thermoplastic Elastomers in Automotive Lightweighting Programs

Auto makers replace traditional vulcanized rubber parts with TPE components that cut vehicle weight and improve fuel economy. These materials process faster than rubber, reducing cycle times in molding plants by 30 to 50 percent. TPEs enable complex part designs through injection molding techniques impossible with conventional rubber compounds that require longer cure times.

Electric vehicle makers adopt TPEs for battery pack seals, cooling system hoses, and cable management parts needing chemical resistance. Weight reduction remains critical as every kilogram saved extends driving range on single battery charges. TPE parts can be recycled at vehicle end-of-life, supporting circular economy goals set by European and Asian governments.

Regulatory pressure for lower emissions drives material substitution as governments mandate better fleet fuel economy standards. US CAFE rules and EU CO2 limits force carmakers to find weight savings across all vehicle systems. TPEs deliver comparable performance to rubber while offering processing advantages that lower making costs and improve design freedom.

Restraints

Volatility in Petrochemical Feedstock Prices Impacting Production Cost Stability

TPE making depends on petroleum-derived monomers like styrene, butadiene, and propylene that face price swings based on crude oil markets. Sudden feedstock cost jumps squeeze margins for compounders unable to quickly raise prices to customers under fixed contracts. Small and mid-size TPE producers lack buying power to lock in long-term raw material agreements.

Global supply chain disruptions from geopolitical events, natural disasters, or pandemic lockdowns create feedstock shortages and price spikes. Makers struggle to forecast costs accurately when raw material prices shift 20 to 40 percent within months. This uncertainty discourages capital investment in new TPE capacity and limits product development budgets at smaller firms.

End users hesitate to switch from established materials when TPE pricing proves unstable compared to alternatives like PVC or thermoset rubbers. Long-term supply agreements become difficult to negotiate when neither party can predict future costs with confidence. Price volatility particularly impacts price-sensitive consumer goods and packaging applications where margins stay thin.

Growth Factors

Development of Bio-Based and Sustainable Thermoplastic Elastomer Formulations

Material scientists create TPE grades using plant oils, corn starch, and other renewable resources to reduce dependence on petroleum feedstocks. Bio-TPEs appeal to consumer brands committed to sustainability goals and carbon footprint reduction across product portfolios. Early commercial bio-based materials achieve 30 to 50 percent bio-content while matching petroleum TPE performance.

Consumer demand for green products drives brands to specify sustainable materials in packaging, footwear, and personal care items. Major retailers set targets requiring suppliers to increase renewable material use by 2030, creating market pull for bio-TPEs. Chemical companies invest in pilot plants proving commercial viability of bio-based styrenic and polyurethane TPE alternatives.

Government incentives and research grants support bio-TPE development as nations seek to reduce industrial carbon emissions. European Union programs fund projects converting agricultural waste into TPE precursors at competitive costs. These efforts help bio-TPEs overcome current price premiums of 15 to 25 percent versus conventional grades.

Emerging Trends

Integration of TPE Compounds with Circular Economy and Closed-Loop Recycling Initiatives

Leading TPE producers partner with brands and recyclers to create systems collecting used products for reprocessing into new materials. Closed-loop programs prove TPEs maintain properties through multiple recycle cycles unlike thermoset rubbers requiring downcycling. Shoe companies pilot take-back programs where worn TPE soles return to making plants for reuse in new footwear.

Chemical recycling technologies break TPE materials into base chemicals for repolymerization into virgin-quality compounds without property loss. Advanced sorting and cleaning methods separate TPEs from mixed plastic waste streams found in recycling facilities. These innovations address concerns about material contamination that previously limited mechanical recycling effectiveness for flexible elastomers.

Brands advertise recycled content in products as competitive advantage attracting environmentally conscious consumers willing to pay premiums. Automotive firms specify recycled TPE grades for non-critical interior parts to demonstrate sustainability commitments to stakeholders. Industry groups develop standards certifying recycled content claims to prevent greenwashing and build consumer trust in circular products.

Thermoplastic Elastomers Market Key Companies Insights

BASF SE operates as a leading global chemical producer offering diverse TPE product lines for automotive, construction, and consumer applications worldwide. The company invests heavily in sustainable TPE development, including bio-based formulations and recycling programs supporting circular economy initiatives. BASF’s technical service teams work closely with customers to develop custom TPE compounds meeting specific performance requirements across industries.

DuPont provides high-performance TPE materials under brands like Hytrel and Zytel targeting demanding applications in automotive and industrial markets. The company focuses on engineering TPE grades with enhanced heat resistance, chemical compatibility, and mechanical strength for critical sealing applications. DuPont leverages global making capabilities and technical expertise to support customers in North America, Europe, and Asia Pacific regions.

Kraton Polymers specializes in styrenic block copolymer technology serving adhesives, paving, personal care, and automotive markets with innovative TPE solutions. The firm develops sustainable polymer grades using renewable pine-based feedstocks to reduce environmental impact of products. Kraton maintains strong market position through continuous innovation in SBC chemistry and processing technology improvements.

ExxonMobil Chemical produces TPE materials through Santoprene and Vistamaxx product families used in automotive, consumer goods, and wire-cable applications globally. The company benefits from integrated petrochemical operations ensuring reliable feedstock supply and competitive cost structure. ExxonMobil expands TPE capacity in Asia to serve growing regional demand from vehicle makers and electronics manufacturers.

Key Companies

- BASF SE

- Arkema SA

- DuPont

- ExxonMobil Chemical

- Kraton Polymers

- Covestro AG

- China Petrochemical Corporation

- Dynasol Elastomers

- EMS-CHEMIE HOLDING AG

- Evonik Industries

- LG Chem

- LCY Chemical Corporation

- Lubrizol Corporation

- LyondellBasell Industries

- Tosoh Corporation

- Avient Corporation

- Teknor APEX Company

- The Dow Chemical Company

- TSRC Corporation

Recent Development

- January 2025 – BASF SE launched new bio-based TPE grade containing 40% renewable content for automotive interior applications. The product targets European automakers seeking sustainable material options without compromising performance or processing efficiency in injection molding operations.

- December 2025 – Kraton Polymers expanded styrenic block copolymer capacity by 25,000 metric tons annually at its Asian facility. This investment supports growing demand from footwear and adhesive makers in China, India, and Southeast Asian markets.

- November 2025 – DuPont introduced flame-retardant TPE compounds meeting UL 94 V-0 standards for electronics housing applications. These materials enable thinner wall sections in consumer device designs while maintaining required fire safety certifications for global markets.

- October 2025 – Covestro AG partnered with major automotive supplier to develop TPE battery seals for electric vehicles operating in temperatures from -40°C to 150°C. The collaboration focuses on improving seal longevity and chemical resistance to battery electrolytes.

- September 2025 – Teknor APEX Company released Uniprene XL series TPV materials with enhanced compression set resistance for sealing applications requiring 140°C continuous use temperature. Products target industrial and automotive customers replacing EPDM rubber with recyclable thermoplastic alternatives.

- August 2025 – LyondellBasell Industries announced $150 million investment to build TPE compounding facility in North America serving automotive and medical device markets. The plant will produce custom formulations with shorter lead times for regional customers.

Market Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 46.70 Billion |

| Forecast Revenue (2035) | USD 103.66 Billion |

| CAGR (2026-2035) | 8.3% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

| Segments Covered | By Type (TPE-S (Styrenic Block Copolymers), TPE-E (Olefinic/TPV), TPE-A (Styrene-Based Alloys), TPE-U (Polyurethane-Based), TPE-V (Vulcanizates), TPE-O (Other/Hybrid Blends)), By Form (Pellets and Granules, Films and Sheets, Compounds, Others (Powder, Strips)), By Application (Automotive and Transportation, Footwear, Medical Devices, Electrical and Electronics, Consumer Goods), By End-Use (Automotive, Healthcare and Medical, Industrial and Construction, Electrical and Electronics, Consumer Goods, Packaging, Others (Sports, Textile, etc.)) |

| Regional Analysis | North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) |

| Competitive Landscape | BASF SE, Arkema SA, DuPont, ExxonMobil Chemical, Kraton Polymers, Covestro AG, China Petrochemical Corporation, Dynasol Elastomers, EMS-CHEMIE HOLDING AG, Evonik Industries, LG Chem, LCY Chemical Corporation, Lubrizol Corporation, LyondellBasell Industries, Tosoh Corporation, Avient Corporation, Teknor APEX Company, The Dow Chemical Company, TSRC Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Purchase Options | We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |