What is the size of the Electric Passenger Cars Market?

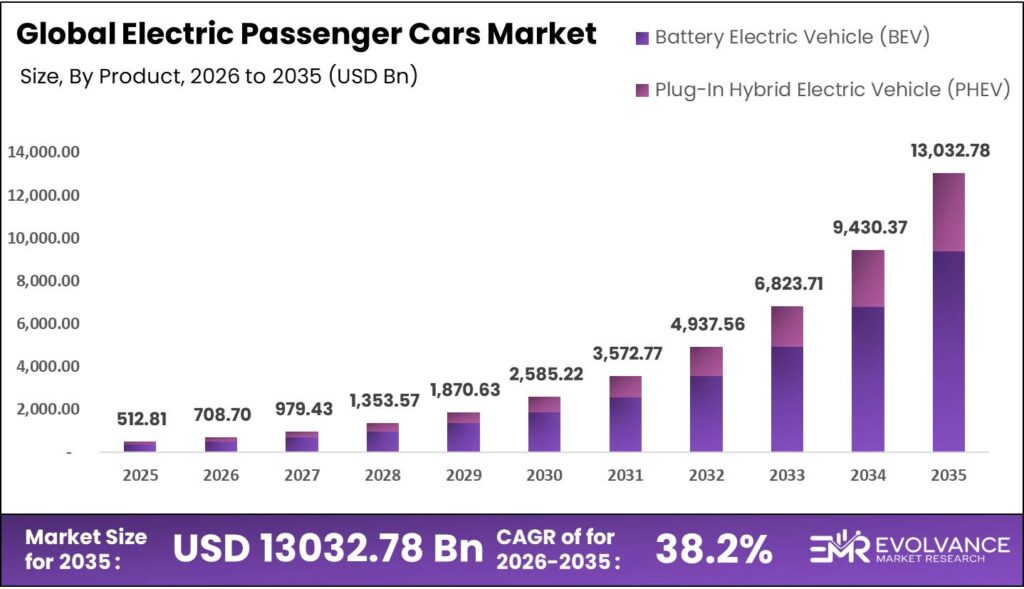

Global Electric Passenger Cars Market size is expected to be worth around USD 13,032.78 Billion by 2035 from USD 512.81 Billion in 2025, growing at a CAGR of 38.2% during the forecast period 2026 to 2035. This rapid growth stems from falling battery costs, expanding charging networks, and strong government support for zero-emission vehicles. Urban air quality concerns and corporate fleet shifts further boost demand for electric mobility across global markets.

Market Highlights

- Global Electric Passenger Cars Market projected to reach USD 13,032.78 Billion by 2035 from USD 512.81 Billion in 2025

- Market expanding at a remarkable CAGR of 38.2% during the forecast period 2026-2035

- Battery Electric Vehicle (BEV) segment dominates with 72.4% market share in 2025

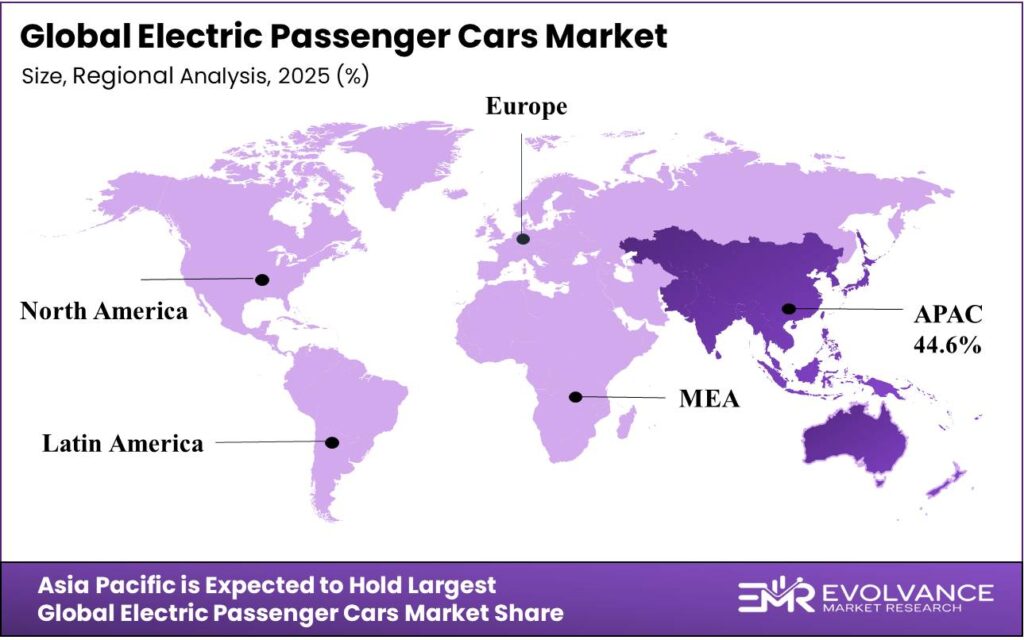

- Asia Pacific leads the regional market with 44.6% share, valued at USD 228.70 billion

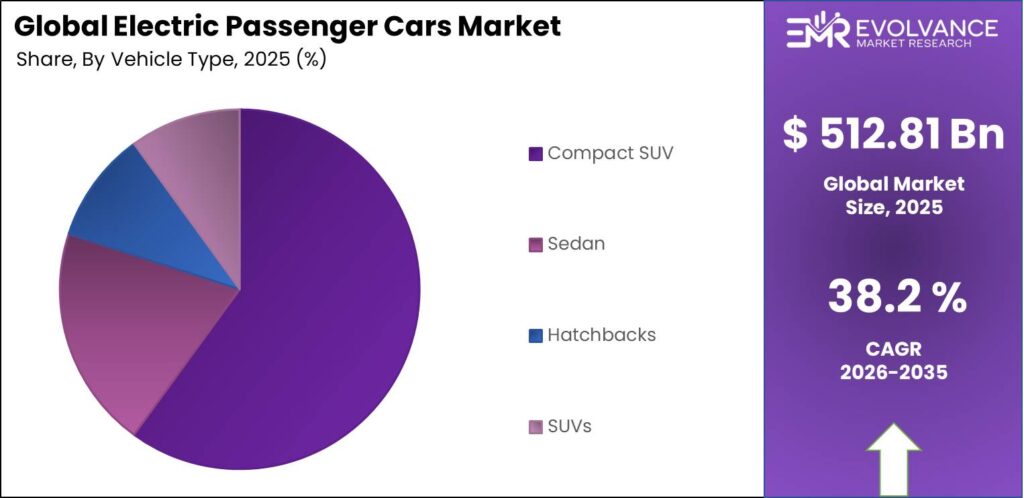

- Compact SUV and Sedan vehicle types drive consumer preference across global markets

Market Overview

Electric passenger cars represent battery-powered or plug-in hybrid vehicles designed for personal travel and daily commuting. These cars use electric motors instead of gas engines to cut carbon output and lower running costs. Models range from compact city cars to luxury sedans and sport utility vehicles across diverse price points.

The shift toward electric mobility gains speed as automakers invest billions in new platforms and battery plants. Major brands now offer electric versions of popular models to meet rising consumer demand for clean transport. Digital features like over-the-air updates and smart energy systems add appeal for tech-focused buyers seeking modern driving experiences.

Government policies play a vital role in market growth through purchase subsidies, tax breaks, and emission rules. Cities worldwide impose strict air quality standards that favor zero-emission vehicles over traditional cars. These rules push automakers to speed up electric model launches and phase out fuel-based production lines in key markets.

Charging network expansion addresses range concerns that previously slowed adoption rates among potential buyers. Fast-charging stations along highways and in urban centers now cut charging time to under thirty minutes. Home charging solutions offer convenience for daily use, while workplace stations support fleet and corporate vehicle programs effectively.

Battery technology advances reduce costs and extend driving range beyond 300 miles per charge for many models. Lithium-ion pack prices dropped significantly over the past decade, making electric cars more affordable for middle-income households. Solid-state batteries promise even better performance with faster charging and longer lifespan in the coming years ahead.

According to EY Global Mobility Consumer Index, 58% of global consumers surveyed say they intend to buy an EV. This rise is slowing with only 3 percentage points of year-over-year growth as charging infrastructure remains a top barrier. Among global prospective EV buyers, lack of charging infrastructure at 27% and, battery-related concerns, including replacement cost at 26% and range anxiety at 25% are top purchase deterrents.

Research by Wifitalents shows 65% of potential EV buyers report charging station availability as a critical factor influencing their decision. Moreover, 43% of consumers feel that complexity of EV charging stations impacts their purchasing decision negatively. However, 78% of EV owners are willing to switch to EVs if charging infrastructure is expanded across more locations.

Automakers invest heavily in local production to avoid import tariffs and serve regional markets more efficiently. Chinese brands expand into Europe while Western companies build plants in Asia to tap growing demand. This global production network supports faster delivery times and better service coverage for electric vehicle customers worldwide.

Product Analysis

Battery Electric Vehicle (BEV) dominates with 72.4% due to zero tailpipe emissions and lower operating costs.

In 2025, Battery Electric Vehicle (BEV) held a dominant market position in the By Product segment of Electric Passenger Cars Market, with a 72.4% share. Pure battery power appeals to eco-conscious buyers seeking complete freedom from fossil fuels and gas stations. These vehicles offer quiet operation, instant torque, and minimal maintenance needs compared to traditional cars with engines. Government incentives specifically target BEVs to meet climate goals and air quality targets in major cities.

Plug-In Hybrid Electric Vehicle (PHEV) serves buyers who need backup range for long trips beyond charging station networks. These models combine electric motors with small gas engines that activate when battery power runs low. PHEVs work well in regions with limited charging access or for drivers who frequently travel between cities. However, their dual powertrains add weight and complexity compared to pure electric designs favored by urban commuters.

Vehicle Type Analysis

Compact SUV dominates due to versatile design, family appeal, and higher seating position preferred by buyers.

In 2025, Compact SUV held a dominant market position in the By Vehicle Type segment of Electric Passenger Cars Market. These vehicles balance cargo space with city maneuverability, making them ideal for families and urban professionals alike. Electric compact SUVs deliver ample battery range while offering practical features like rear seat room and storage capacity. Strong demand in China, Europe, and North America drives automakers to prioritize this segment with new launches.

Sedan models attract buyers who value aerodynamic efficiency and classic styling in their electric vehicle choice. Lower ride height improves range by cutting wind resistance during highway travel compared to taller SUV designs. Premium electric sedans compete with luxury gas cars through advanced tech features and smooth acceleration performance. This segment maintains steady growth in markets where traditional sedan preference remains strong among car buyers.

Hatchbacks serve price-conscious urban buyers seeking affordable entry points into electric vehicle ownership and daily commuting. Compact dimensions make parking easier in crowded city streets while smaller batteries keep purchase costs lower. European and Asian markets show particular preference for electric hatchbacks as practical city cars with decent range. Automakers use this segment to build volume sales and introduce new customers to electric driving benefits.

SUVs target buyers wanting maximum space, off-road capability, and premium features in full-size electric vehicle platforms. Large battery packs enable longer range despite higher energy consumption from increased weight and size. Three-row seating options appeal to large families while towing capacity serves recreational users with boats or trailers. Premium pricing reflects advanced technology and luxury appointments that compete with high-end traditional SUV models effectively.

Market Segments Covered in the Report

By Product

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

By Vehicle Type

- Compact SUV

- Sedan

- Hatchbacks

- SUVs

Electric Passenger Cars Market Regional Insights

Asia Pacific Dominates the Electric Passenger Cars Market with a Market Share of 44.6%, Valued at USD 228.70 Billion

Asia Pacific leads global electric passenger car sales driven by China’s massive production scale and strong policy support. The region accounts for 44.6% of market share, valued at USD 228.70 Billion in 2025. Chinese automakers like BYD and SAIC produce affordable models that appeal to cost-conscious buyers across emerging markets. Japan and South Korea contribute advanced battery technology and premium electric vehicle offerings to diverse consumer segments. Government subsidies and charging network investments accelerate adoption rates faster than Western markets in this region.

North America Electric Passenger Cars Market Trends

North America shows strong growth as US automakers invest billions in electric vehicle plants and battery factories. Federal tax credits up to several thousand dollars reduce purchase prices for qualifying models and buyers. Tesla maintains market leadership while traditional Detroit brands launch electric trucks and SUVs for American tastes. Canada follows similar policy paths with provincial incentives supporting zero-emission vehicle targets across major cities nationwide.

Europe Electric Passenger Cars Market Trends

Europe pushes aggressive emission rules forcing automakers to shift production away from diesel and gas engines. Countries like Norway and Netherlands lead adoption with electric cars representing majority of new vehicle sales. German luxury brands compete with Chinese imports as buyers choose between premium features and affordable pricing. Charging infrastructure reaches high density in Western Europe while Eastern regions work to catch up quickly.

Latin America Electric Passenger Cars Market Trends

Latin America emerges as growth market as Chinese and Western brands establish local production in Brazil and Mexico. Import tariffs favor locally-built models while limited charging networks slow adoption outside major urban centers currently. Government incentives remain modest compared to other regions but environmental concerns drive policy changes in largest cities. Affordable compact models suited to regional income levels will determine market expansion pace over coming years.

Middle East & Africa Electric Passenger Cars Market Trends

Middle East & Africa represents early-stage market with limited adoption concentrated in wealthy Gulf states and South Africa. High fuel subsidies in oil-producing nations reduce economic incentive for electric vehicle ownership among local buyers. However, governments diversify economies by attracting electric vehicle manufacturing and charging infrastructure investments for future growth. South Africa leads regional adoption supported by renewable energy expansion and urban pollution concerns in major cities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Regulatory Landscape

Governments worldwide enforce strict carbon emission targets that push automakers toward electric vehicle production and sales quotas. The European Union set 2035 as the deadline for ending new gas car sales across member states. California and several US states follow similar paths with zero-emission vehicle mandates requiring specific percentages of electric sales. China maintains dual-credit system rewarding EV production while penalizing traditional vehicle output from major manufacturers operating domestically.

Safety standards evolve to address battery fire risks and crash protection in electric vehicle designs globally. Testing protocols now include battery impact assessments and thermal runaway prevention measures for lithium-ion pack installations. Regulatory bodies require automakers to demonstrate compliance with electromagnetic compatibility rules preventing interference with other vehicle systems. These quality standards ensure electric passenger cars meet the same safety benchmarks as traditional vehicles.

Drivers

Rapid Decline in Lithium-Ion Battery Costs Enhancing Vehicle Affordability

Battery pack prices dropped over 80% in the past decade, making electric cars competitive with gas vehicles. Lower costs allow automakers to offer more affordable models targeting middle-income buyers across global markets. Mass production of battery cells drives economies of scale that reduce per-unit expenses for manufacturers significantly. Chinese battery makers lead cost reduction through vertical integration and high-volume output supporting price-sensitive market segments.

Cheaper batteries enable longer range without premium pricing that previously limited electric vehicles to luxury segments. Automakers now build mainstream models with 250 to 300 mile range at accessible price points. This affordability shift expands addressable market beyond early adopters to average car buyers considering their next purchase. Fleet operators also benefit from lower total ownership costs when battery replacement expenses decline over vehicle lifetime.

Technology advances in battery chemistry improve energy density while reducing raw material costs for key components. New cell designs use less cobalt and more abundant materials like iron phosphate for budget models. These innovations maintain performance standards while cutting production expenses that get passed to consumers through pricing. Government subsidies combined with natural cost curves accelerate electric vehicle adoption across diverse income levels worldwide.

Restraints

Limited Driving Range Compared to Conventional Fuel Vehicles

Range anxiety persists as major barrier despite improvements in battery capacity across newer electric vehicle models. Most affordable models deliver 150 to 250 miles per charge compared to 400 plus miles for gas cars. Cold weather reduces range by up to 30% in winter conditions, creating uncertainty for buyers in northern climates. Highway driving at high speeds drains batteries faster than city use, limiting long-distance travel flexibility significantly.

Charging time remains longer than gas refueling even with fast-charging technology available at public stations. Quick charges to 80% capacity take 20 to 40 minutes compared to five-minute gas fills. This time difference impacts buyers who lack home charging access and depend on public infrastructure for daily needs. Long road trips require careful planning around charging stop locations that may not align with preferred routes.

Battery degradation over time reduces maximum range as vehicles age through repeated charge and discharge cycles. Older electric cars lose 10 to 20% of original capacity after five years of normal use. This gradual decline affects resale values and creates concerns about long-term ownership costs for budget-conscious buyers. Replacement battery expenses remain high despite falling new pack prices from manufacturers and suppliers in the market.

Growth Factors

Integration of Solid-State Battery Technology for Extended Range

Solid-state batteries promise breakthrough improvements in energy density, safety, and charging speed over current lithium-ion technology. These next-generation packs could deliver 500 plus mile range in standard vehicles without weight penalties. Major automakers invest billions in solid-state development targeting commercial launch in late 2020s for premium models. Elimination of liquid electrolytes reduces fire risk while enabling faster charging that matches gas refueling convenience levels.

Extended range capability from solid-state technology eliminates primary barrier preventing mainstream buyers from switching to electric vehicles. Longer driving distances between charges address range anxiety that currently limits adoption in rural and suburban areas. Higher energy density allows smaller, lighter battery packs that improve vehicle efficiency and performance across all segments. Manufacturing scale-up remains key challenge but pilot production lines validate commercial viability for volume deployment soon.

Corporate partnerships between automakers and battery companies accelerate solid-state development timelines and production readiness plans. Joint ventures pool research resources and share financial risks associated with new technology commercialization efforts. Successful deployment will reshape competitive dynamics as brands with solid-state access gain significant product advantages. This technology shift represents major growth catalyst that could double addressable market size within next decade.

Emerging Trends

Adoption of AI-Based Energy Management in Electric Cars

Artificial intelligence systems optimize battery usage by learning driver patterns and predicting energy needs for upcoming trips. Smart algorithms adjust power delivery, climate control, and route planning to maximize range from available charge. These systems analyze traffic conditions, weather data, and terrain to recommend efficient driving strategies in real time. Machine learning improves over time as vehicles collect more data about individual driving habits and preferences.

AI-powered features enhance user experience through personalized settings that adapt to different drivers and trip purposes. Predictive charging schedules optimize home electricity rates by charging during off-peak hours when costs are lowest. Vehicle-to-grid integration allows AI to sell excess battery power back to utilities during high-demand periods. These intelligent energy management capabilities add value beyond basic transportation and appeal to tech-savvy buyers significantly.

Automakers differentiate products through proprietary AI algorithms that deliver superior range and performance from same battery hardware. Over-the-air updates continuously improve energy management without requiring physical service visits or hardware changes. This software-defined approach transforms electric cars into constantly evolving products that gain features after purchase. AI integration represents key competitive advantage as buyers prioritize smart technology in vehicle purchasing decisions going forward.

Electric Passenger Cars Market Key Companies Insights

Tesla, Inc. maintains global leadership in electric passenger cars through vertical integration covering batteries, software, and charging networks. The company pioneered long-range EVs and continues setting industry benchmarks for performance and autonomous driving technology. Strong brand loyalty and direct sales model differentiate Tesla from traditional automakers relying on dealer networks. Gigafactories in multiple countries support global expansion while maintaining quality control and production efficiency across all markets.

BYD Company Ltd. leads Chinese EV market with diverse portfolio spanning affordable compacts to premium sedans and SUVs. The company produces its own batteries and semiconductors, reducing supply chain risks and controlling costs effectively. In January 2026, BYD began trial production at its new Szeged, Hungary factory with nearly 1,000 workers. This European manufacturing base positions BYD to avoid import tariffs and serve local markets more competitively.

Volkswagen Group (Volkswagen AG) transforms legacy operations toward electric future with massive investments in MEB platform technology. The group targets electric versions across all brands from budget Skoda to luxury Audi and Porsche models. Extensive dealer network in Europe and China provides distribution advantage over newer EV-only competitors in established markets. Partnership strategy with battery suppliers secures long-term capacity for planned production ramp reaching millions of units annually.

General Motors Company focuses on affordable EV strategy with upcoming 2027 Chevrolet Bolt re-launch priced around $29,990. The company announced in October 2025 that the new Bolt will be one of its main volume EV products alongside Equinox EV. GM leverages Ultium battery platform across multiple brands from Chevrolet to GMC and Cadillac luxury vehicles. Strong truck heritage positions company to capture commercial and fleet markets transitioning to electric powertrains in North America.

Key Companies

- Rivian Automotive, Inc.

- Toyota Motor Corporation

- Fisker Inc.

- SAIC Motor Corporation Limited

- Mercedes-Benz Group AG (formerly Daimler AG)

- Karma Automotive

- Tesla, Inc.

- Mitsubishi Motors Corporation

- Volkswagen Group (Volkswagen AG)

- Lucid Motors

- Ford Motor Company

- BYD Company Ltd.

- Nissan Motor Co., Ltd.

- General Motors Company

Recent Development

- December 2025 – Foxtron Vehicle Technologies launched its first Taiwan-made electric vehicle called the Bria EV aimed at export markets. The company completed acquisition of Yulon Motor’s Luxgen passenger-car brand to strengthen its EV value chain and expand production capabilities.

- March 2025 – Kia officially announced the EV4 electric sedan and hatchback as an affordable long-range electric passenger car. Different battery options target Europe and Korea markets, with launch scheduled for 2025 to compete in mainstream segments.

- August 2025 – Chinese EV maker Li Auto consolidated its electric SUV lineup with launch of second pure electric model. The six-seater electric multipurpose vehicle called Mega reinforces the company’s electric passenger car portfolio and family-focused product strategy.

- January 2025 – Škoda launched the Elroq electric compact crossover SUV, a fully electric passenger model based on Volkswagen Group MEB platform. Production began in January 2025 to serve European markets with affordable electric compact options for buyers.

Market Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 512.81 Billion |

| Forecast Revenue (2035) | USD 13,032.78 Billion |

| CAGR (2026-2035) | 38.2% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

| Segments Covered | By Product (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV)), By Vehicle Type (Compact SUV, Sedan, Hatchbacks, SUVs) |

| Regional Analysis | North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) |

| Competitive Landscape | Rivian Automotive, Inc., Toyota Motor Corporation, Fisker Inc., SAIC Motor Corporation Limited, Mercedes-Benz Group AG (formerly Daimler AG), Karma Automotive, Tesla, Inc., Mitsubishi Motors Corporation, Volkswagen Group (Volkswagen AG), Lucid Motors, Ford Motor Company, BYD Company Ltd., Nissan Motor Co., Ltd., General Motors Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Purchase Options | We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |