What is Creator Economy Market Size?

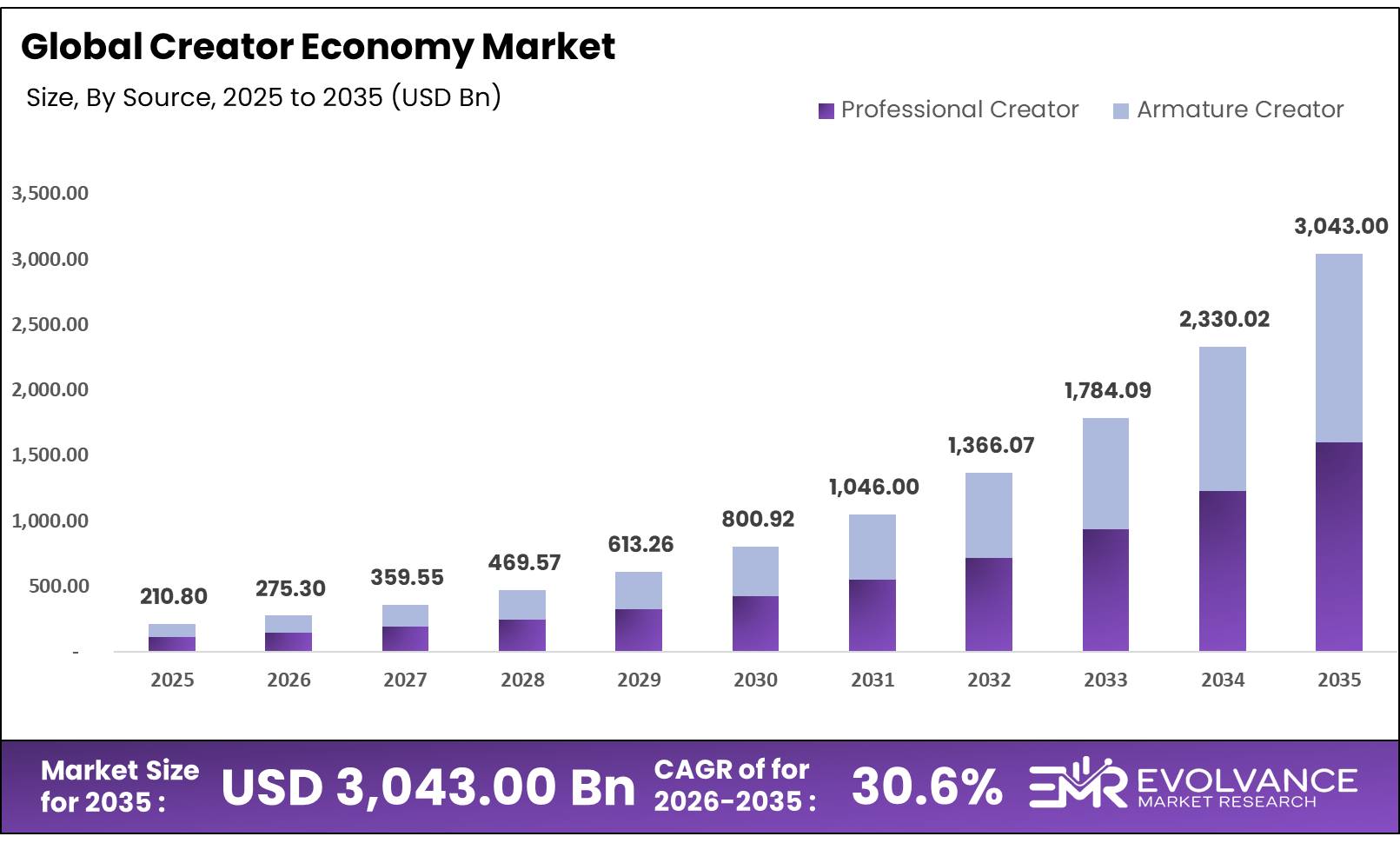

The Global Creator Economy Market size is calculated at USD 210.80 billion in 2025 and is predicted to increase from USD 275.30 billion in 2026 to approximately USD 3,043.00 billion by 2035, expanding at a CAGR of 30.6% from 2026 to 2035. The Creator Economy has become one of the fastest-growing business ecosystems in the digital world. It includes everyone who builds an audience online — influencers, digital entrepreneurs, streamers, educators, and independent creatives — along with the platforms and tools that help them earn revenue.

Market Highlights

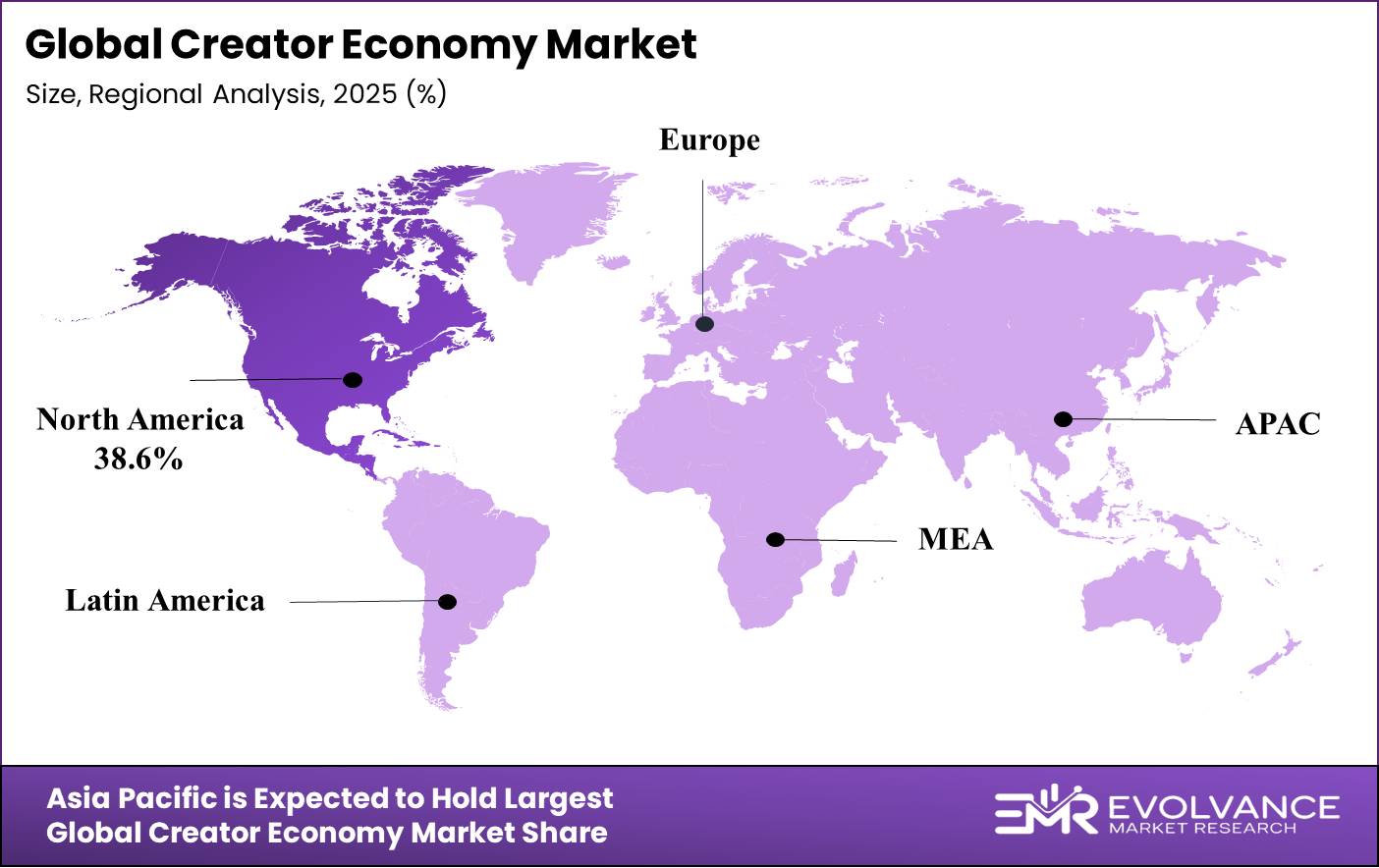

- By region, North America dominated the market, holding largest share of 38.5% in the market during 2025.

- By region, Asia Pacific is expected to expand at the fastest CAGR of 36.8% between 2026 and 2035.

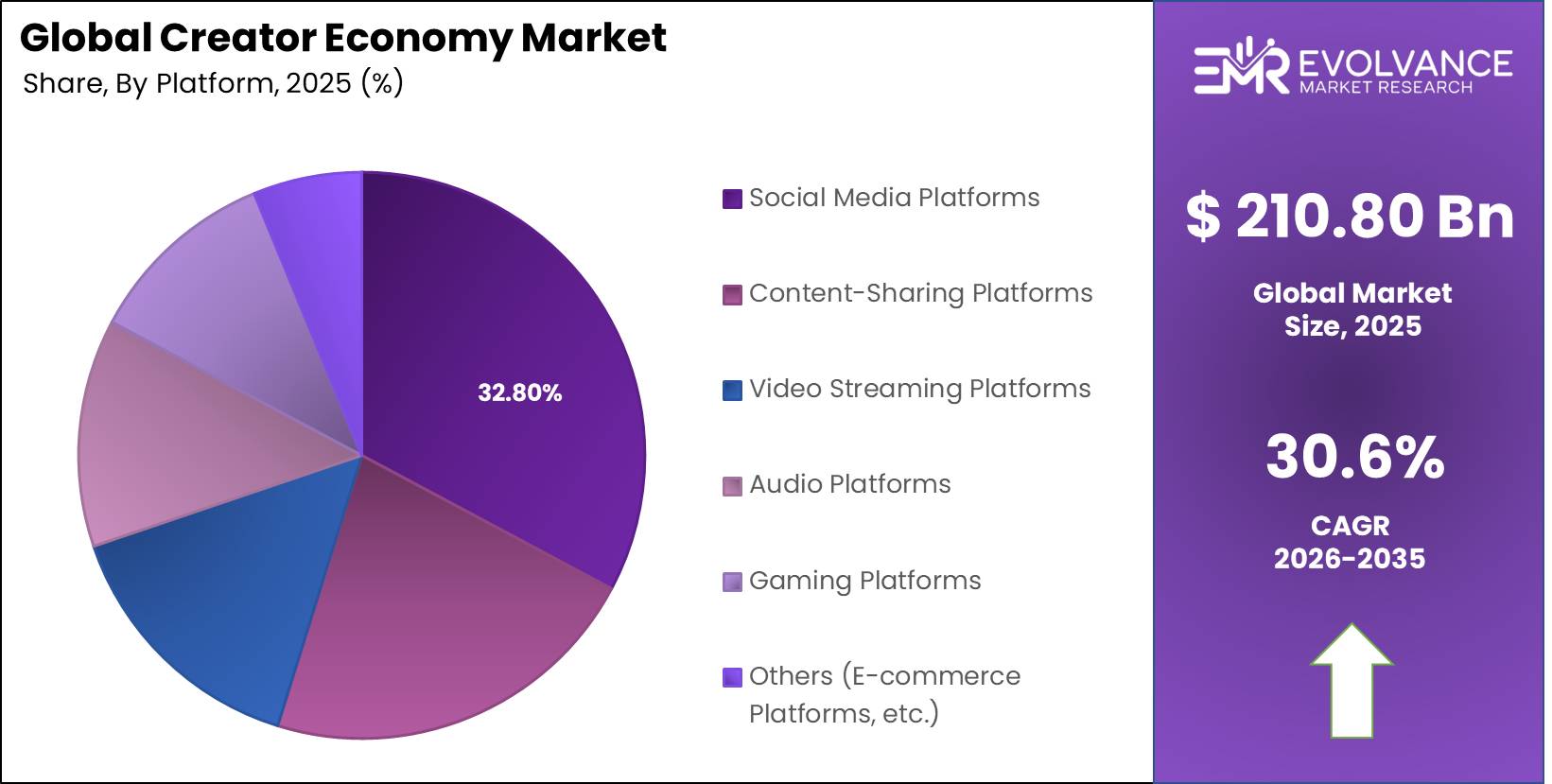

- By Platform, the Social Media Platforms segment contributed the biggest market share of 32.8% in 2025.

- By Platform, Video Streaming Platforms is expected to grow at a remarkable CAGR of 34.5% between 2025 and 2035.

- By Content Type, Video content segment held the major market share of 28.5% in 2025.

- By Content Type, Music content is projected to grow at a remarkable CAGR of 32.2% between 2025 and 2035.

- By Monetization Method, the Advertising Revenue segment captured the highest market share of 25.6% in 2025.

- By Monetization Method, the Brand Collaborations segment is growing at a remarkable CAGR of 35.4% between 2025 and 2035.

- By End User, the Armature Creator segment held the largest market share of 66.7% in 2025.

- By End User, Professional Creator segment is expanding at a strong of 34.6% CAGR between 2025 and 2035.

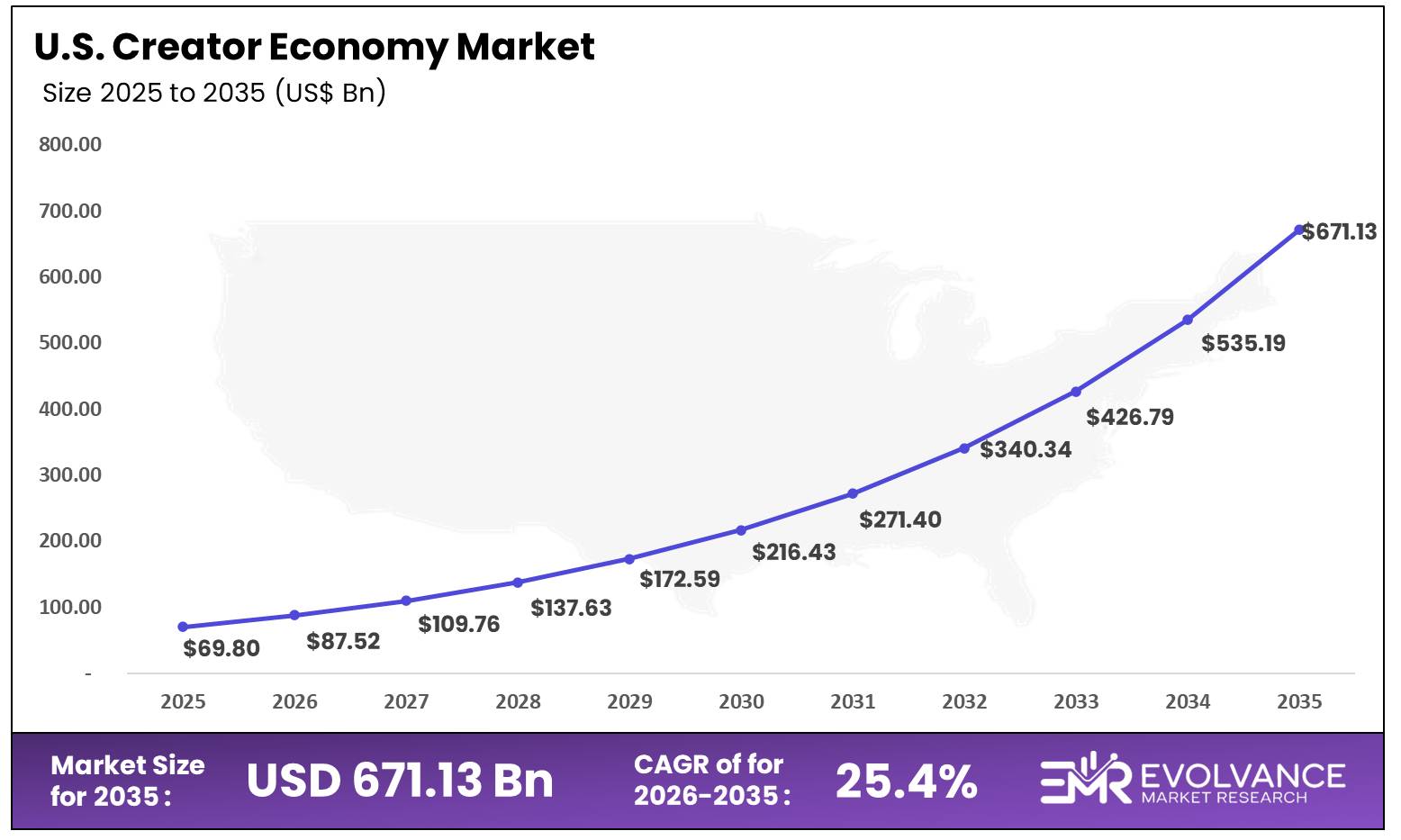

U.S. Creator Economy Market Size and Growth 2025 to 2035

The U.S. Creator Economy Market size is exhibited at USD 69.80 billion in 2025 and is projected to be worth around USD 671.13 billion by 2035, growing at a CAGR of 25.4% from 2026 to 2035. U.S. creator economy growth is driven by social media reach, short video demand, brand shift to influencer marketing, easy monetization tools, mobile-first audiences, data-driven ads, niche communities, and trust in authentic voices.

Market Size and Forecast

- Market Size in 2025: USD 190.26 Billion

- Market Size in 2026: USD 248.48 Billion

- Forecasted Market Size by 2034: USD 2,102.98 Billion

- CAGR (2026-2035): 30.6%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

What Is the Creator Economy?

The creator economy is a fast-growing digital ecosystem where individuals build brands, share content, and earn money directly from their audience. Unlike the traditional media model—where only large companies-controlled production and distribution—today creators can use platforms like YouTube, Instagram, TikTok, LinkedIn, and podcasts to reach millions without needing big studios or agencies.

At its core, the creator economy is powered by people who use their skills, personality, or expertise to attract a community. These creators then monetize through several channels such as advertising, brand deals, digital products, subscription content, affiliate marketing, and even their own businesses.

What makes this economy unique is that trust and authenticity are its main currencies. Audiences increasingly prefer real-world voices over scripted, celebrity-driven content. As a result, creators are becoming powerful partners for brands and a major influence on consumer decision-making. The creator economy also involves a wide network of +3 agencies, editing tools, and marketplaces for digital products. Together, they help creators scale their work into sustainable careers.

In simple terms, the creator economy transforms everyday people into entrepreneurs by giving them the tools and platforms to create, connect, and earn. It is reshaping how content is produced, how brands communicate, and how audiences consume Information.

Platform Insights

Why Social Media Platforms Is Dominating the Creator Economy Market?

The Social Media Platforms is dominating the Creator Economy market by holding a share of 32.8%, as they act as the primary discovery engine, audience hub, and monetization gateway for creators worldwide. Platforms like Instagram, YouTube, TikTok, and Facebook form the digital infrastructure where creators build communities, distribute content instantly, and interact directly with followers. Their dominance comes from massive user bases, easy-to-use tools, and algorithm-driven visibility that enable creators to scale quickly.

The sector’s leadership is not just due to its large audience volume but its strategic role in shaping creator visibility and engagement. Social platforms serve as the first touchpoint where creators establish identity, credibility, and audience trust. Features such as short videos, reels, live streaming, branded content tags, and integrated shopping tools turn these platforms into high-conversion ecosystems. As user-generated content consumption grows, platforms continue investing in AI-driven feeds, creator funds, and monetization pathways. This positions social media as the operational backbone of the creator economy — accessible, scalable, and indispensable.

The Video streaming platforms is the fastest-growing in the Creator Economy market and are expected to grow at a 34.5% CAGR. This growth is driven by rising demand for long-form content, premium video quality, audience loyalty, and subscription-led revenue models. Unlike short social videos, streaming platforms offer creators deeper engagement, higher watch time, and diversified income streams like paid memberships, ads, tipping, and exclusive content.

The segment’s rapid expansion comes from the shift toward immersive, community-driven, and monetizable video experiences. With improvements in broadband, 5G penetration, and low-latency streaming, creators can now host live shows, gaming streams, webinars, and long-format storytelling without technological barriers. Video-first consumption is becoming a global norm, and streaming platforms are evolving into digital studios empowering creators with advanced analytics, editing suites, and monetization dashboards.

Content Type Insights

Why the Video Content Is Dominating the Creator Economy Market?

The Video Content is dominating the Creator Economy market by holding a share of 28.5%, driven by its unmatched ability to deliver high-impact engagement, visual storytelling, and audience retention. Short-form videos, livestreams, product demos, vlogs, and educational content have become the backbone of creator monetization across YouTube, TikTok, Instagram Reels, and streaming platforms. As platforms aggressively invest in video-first algorithms, creators benefit from higher visibility, stronger audience emotionally connection, and better monetization opportunities. The dominance of video stems from its ability to convert casual viewers into loyal followers faster than any other format, making it the centrepiece of the digital content ecosystem.

The segment’s leadership is not just due to its popularity but its strategic value. Brands prioritize video for influencer campaigns, performance marketing, and storytelling because it communicates authenticity and drives measurable business outcomes. Features such as shoppable videos, live commerce, Super Chats, paid subscriptions, and ad-based revenue models have strengthened video’s position as the most profitable content category. With rising smartphone penetration, 5G expansion, and on-the-go consumption trends, video remains the core engine powering creator engagement, audience expansion, and revenue streams. Its dominance reflects a long-term structural shift toward immersive, visual-first digital experiences.

The Music Content is are fastest growing in the Creator Economy market with an expected CAGR of 32.2%. This surge is fuelled by the rapid integration of music into short-form video apps, gaming platforms, digital concerts, virtual events, and creator-led music remixes. Independent artists, DJs, and music creators now leverage platforms like Spotify, YouTube Music, TikTok, and SoundCloud to distribute music globally without traditional record label dependency. AI-assisted music creation tools, royalty-free sound libraries, and creator-friendly licensing frameworks are accelerating adoption across sectors.

The segment’s rapid growth is driven by rising demand for micro-music formats — hooks, beats, samples, and background scores — that power millions of daily videos online. Music has evolved into an asset class that enables creators to monetize across streaming royalties, brand partnerships, sync licensing, live performances, and fan-funded platforms. As virtual reality concerts, AI-generated soundtracks, and interactive music experiences become mainstream, music content is set to outpace other segments in innovation and revenue potential. The next decade will see music transform from a supporting element to a standalone creator ecosystem fuelled by creativity, technology, and global digital distribution.

Monetization Method Insights

Why Advertising Revenue Is Dominating the Creator Economy Market?

Advertising Revenue is dominating the Creator Economy market by holding a share of 25.6%, driven by the massive dependence of creators and platforms on ad-based monetization. Most digital platforms—including YouTube, Instagram, Facebook, TikTok, and Snapchat—operate on advertising-first models where brands fund creator payouts through video ads, sponsored placements, and in-feed promotions.

The explosive rise of short-form content has accelerated ad inventory expansion, enabling platforms to scale monetization rapidly. With billions of users consuming content daily, advertisers view creator-driven content as a high-ROI channel due to its superior engagement and precision targeting.

The dominance of advertising revenue is not simply due to its scale but its structural advantage. Advertising acts as the default monetization layer for creators, especially those in early and mid-growth stages, enabling earnings without subscription barriers. As platform algorithms evolve, ad formats—such as shoppable ads, performance ads, and contextual video ads—are becoming smarter, increasing both impressions and conversion rates.

Brands are diverting budgets away from traditional media and allocating higher spends to creator-led campaigns that deliver authenticity, traceability, and audience trust. With rising digital video consumption and increasing platform investments in AI-driven ad optimization, advertising revenue remains the powerhouse of the creator economy—predictable, scalable, and continually expanding.

The Brand Collaborations are the fastest growing in the Creator Economy market with an expected growth rate of 35.4%. The surge is driven by brands increasingly preferring creators over traditional celebrity endorsements due to better relatability, niche audience targeting, and measurable ROI. Sponsored content, brand ambassadorships, product placements, and affiliate partnerships have evolved into strategic, long-term collaborations where creators shape consumer perception more authentically than traditional ads.

The segment’s rapid growth is fuelled by the shift toward performance-based influencer marketing, where brands reward creators based on engagement, clicks, conversions, and sales impact. Additionally, micro and nano creators—known for their high trust communities—are attracting significant brand budgets, widening the scope of collaborations across industries such as beauty, fintech, gaming, fitness, and consumer electronics. As brands adopt data-driven creator selection tools and AI-powered influencer analytics, partnerships are becoming more customized, transparent, and outcome-focused.

The coming years will witness a transition from one-time sponsorships to structured creator-brand ecosystems, where creators co-develop products, participate in marketing strategy, and even act as long-term strategic partners. This evolution positions brand collaborations as the fastest-growing monetization method, reflecting a market shift toward value-driven, measurable, and high-impact content partnerships.

End User Insights

Why Are Armature Creator Dominating the Creator Economy Market?

The Armature Creator is dominating the Creator Economy market by holding a share of 66.7%, driven by the explosive rise of accessible creation tools, low entry barriers, and platform-led monetization programs. These creators—everyday individuals producing content from smartphones, basic editing apps, and social platforms—form the widest base of the ecosystem. Their dominance stems from volume, diversity, and authentic engagement. Social media algorithms increasingly reward relatable content over high-budget production, allowing millions of aspiring creators to participate without technical expertise.

This leadership is rooted not in professional sophistication but in community-led influence, where creators build micro-niche audiences through storytelling, lifestyle content, tutorials, and opinion-led videos. Platforms like TikTok, Instagram Reels, and YouTube Shorts have democratized creation, enabling anyone to gain traction overnight.

Brands recognize the trust consumers place in relatable creators, sparking demand for micro-influencer collaborations that deliver higher ROI than celebrity endorsements. Thus, amateur creators remain the backbone of the creator economy—agile, relatable, and rapidly scalable.

The professional creator segment is projected to record the highest CAGR of nearly 18% within the creator economy market. With increasing expectations for premium content, structured monetization, and brand-grade storytelling, professional creators are rapidly scaling the commercial potential of the ecosystem. High-quality production, consistency, and data-driven content strategies are enabling these creators to convert audiences into paying communities across subscriptions, merchandise, online courses, and digital products.

Their accelerated growth is supported by the formalization of the creator business model. Professionals invest in advanced tools—studio equipment, editing software, analytics dashboards, and CRM solutions—to maximize reach and revenue. Brands now allocate significant portions of marketing budgets to top-tier creators who guarantee performance-based campaigns, professional deliverables, and multi-platform presence. As creators transition from hobbyists to entrepreneurs, they evolve into small businesses with teams managing scripting, editing, sponsorships, and community engagement.

Segments Covered in the Report

By Platform

- Social Media Platforms

- Content-Sharing Platforms

- Video Streaming Platforms

- Audio Platforms

- Gaming Platforms

- Others (E-commerce Platforms, etc.)

By Content Type

- Video

- Written

- Gaming

- Music

- Photography, Art, and Memes

- Audio

- Others (Educational, etc.)

By Monetization Method

- Advertising Revenue

- Subscriptions

- Donations and Tips

- Affiliate Marketing

- Brand Collaborations

- Merchandise

- Others

By End User

- Professional Creator

- Armature Creator

Creator Economy Market Outlook

- Industry Growth Overview: The creator economy is moving through a decisive expansion phase, driven by the global shift toward digital-first lifestyles and the growing preference for personalized, community-driven content. As audiences’ fragment across platforms, brands are increasingly relying on independent creators to bridge the gap between consumer expectations and authentic engagement.

- Sustainability Trends: Sustainability within the creator economy extends far beyond environmental concerns—it’s about long-term career viability, responsible content production, and the ethical use of emerging technologies. Creators are increasingly prioritizing diversified income models such as memberships, digital products, co-created merchandise, and brand retainers to reduce dependence on volatile algorithm-based earnings.

- Major Investors: The creator economy has evolved into a high-priority investment landscape for venture capital firms, media conglomerates, and technology platforms. Investors are increasingly drawn to creator-focused SaaS tools, monetization platforms, virtual production studios, and AI-driven creator enablement technologies.

- Startup Economy: The startup ecosystem surrounding the creator economy is thriving with innovation and experimentation. New ventures are emerging across niches such as AI-based content production, fan engagement analytics, micro-learning platforms, multi-platform publishing engines, and virtual storefronts designed specifically for creators.

Key Market Trends

- Expansion of 5G-enabled live and low-latency formats that increase high-quality livestream commerce and interactive shows.

- Rapid adoption of AI-assisted content tooling (script assistants, video editing, audio clean-up) that compress production time and raise output quality.

- Creator commerce maturation — embedded storefronts, direct drops, and white-label merch + fulfilment reduce friction from content → purchase.

- Subscription & community monetization replaces one-off creator income with predictable recurring revenue (tiered memberships, private communities).

- Platform revenue-share & policy evolution — creators negotiate for better splits and transparent policies; alternative models (cooperatives, creator-owned platforms) emerge.

- Regionalization of influencer markets — local creators capture culturally relevant audiences; brands invest regionally rather than only global stars.

- Professionalization & talent infrastructure — specialized agencies, creator accounting, legal support and brand strategy become standard offerings.

- Attention to creator welfare & rights — mental health, contract fairness, and IP ownership create new service opportunities and regulatory scrutiny.

Market Value Chain Analysis in Creator Economy

- Raw Material Sources: The creator economy relies on a rich flow of digital assets—videos, images, audio, livestreams, and written content—produced through everyday devices like smartphones and affordable software tools. This low barrier to creation fuels massive content output and continuous market expansion.

- Technology Used: AI editing tools, recommendation engines, cloud storage, live-streaming systems, and secure digital payment platforms form the technology backbone of the creator ecosystem. These tools enhance content quality, expand reach, and unlock multiple monetization channels.

- Investment by Investors: Global investors are rapidly funding creator platforms, influencer marketing start-ups, social commerce tools, and creator-centric SaaS solutions. Continuous investments from tech giants and venture firms are accelerating innovation, making the market one of the fastest-growing digital segments.

- AI Advancements: AI is reshaping creator workflows with automated video editing, smart captions, performance analytics, and hyper-personalized recommendations. These advancements boost creator productivity, increase viewer engagement, and strengthen monetization—making AI the biggest growth catalyst in the market.

Regional Insights

Why Is North America Leading the Creator Economy Market?

North America dominates the Global Creator Economy Market with a 38.6% share, because it combines strong digital spending, advanced platforms, and a mature ecosystem that supports creator monetization.

The region has the highest advertising and consumer spending on digital content, which directly increases creator earnings through ads, brand collaborations, and paid subscriptions. Most major creator platforms—such as YouTube, Instagram, TikTok, and Patreon—operate large parts of their product, monetization, and innovation teams in North America, giving creators early access to new tools and better revenue opportunities. Consumers in the region also show a higher willingness to pay for exclusive content, memberships, and tipping, which boosts direct income for creators.

Along with this, the market benefits from a developed financial and payment infrastructure, strong e-commerce integration, and easy-to-use creator tools that make content monetization simple and reliable.

North America also attracts significant venture capital investments in creator-focused startups, agencies, and technology solutions, further strengthening its competitive position. The region’s cultural influence and global reach of English-language content help creators tap into worldwide audiences, increasing scale and revenue. Altogether, these advantages make North America the most mature and commercially attractive region in the global creator economy.

Canadian Model in the Creator Economy Market

The Canadian model in the creator economy is built on a balanced ecosystem of strong digital infrastructure, government support, and a fast-growing community of creators who produce high-quality content for both domestic and global audiences. Canada has positioned itself as a creator-friendly market by combining large-scale platform usage (YouTube, TikTok, Instagram) with policies that encourage digital entrepreneurship.

Government programs such as the Canada Media Fund (CMF), Creative Canada Policy Framework, and provincial tax incentives help independent creators, production studios, and digital storytellers access funding, training, and resources. This gives Canadian creators a financial and professional advantage compared to many other regions.

Why Is the Asia Pacific Leading the Charge in the Creator Economy Market?

Asia Pacific stands as the fastest-growing region in the Creator Economy market, with an expected CAGR of 36.8%, due to the region combines the world’s largest internet user base with rapid digital adoption and a strong mobile-first culture. Countries such as India, China, Indonesia, Japan, and South Korea have millions of young, highly engaged users who spend a significant amount of time on short-form video, live streaming, gaming, and social commerce platforms. This large audience gives creators faster growth and higher engagement compared to most global markets.

Asia Pacific also benefits from local tech giants—like TikTok, YouTube, Kuaishou, Bilibili, and India’s homegrown apps—that continuously launch new monetization tools such as live gifting, virtual goods, in-app tipping, and commerce integrations. These features help creators earn money quickly, even without traditional brand deals.

The region’s strong e-commerce ecosystem makes influencer-led shopping extremely successful, allowing creators to drive direct sales for brands. Additionally, affordable smartphones, low-cost data plans, and expanding digital payment systems make it easy for people to create and consume content anywhere. With governments and businesses increasingly supporting digital entrepreneurship, Asia Pacific has become a fast-moving, high-growth hub where creators can scale quickly and build large communities—making it the most dynamic and rapidly expanding region in the global creator economy.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- ASEAN Countries

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Top Creator Economy Market Companies

- Alphabet: Alphabet drives creator growth through YouTube’s global dominance, offering advanced ad monetization, analytics, and creator tools. Its expanding Shorts ecosystem, AI-powered recommendations, and strong advertiser base make it a core revenue engine in the creator economy.

- Amazon: Amazon strengthens the creator ecosystem through Twitch, Amazon Live, and affiliate programs. Its commerce-driven model, Prime integration, and livestream shopping capabilities enable creators to monetize audiences through subscriptions, product promotions, and real-time engagement.

- Meta Platforms: Meta leads through Instagram and Facebook, offering global reach, Reels expansion, and diversified creator monetization. Strong ad infrastructure, brand partnerships, and AI-driven discovery empower creators to scale audiences and earnings across multiple formats.

- ByteDance: ByteDance fuels the creator economy with TikTok’s viral algorithm, short-form innovation, and strong creator marketplace. Its commerce-integrated features, global engagement, and rapid content circulation make it a critical growth platform for creators worldwide.

Top Key Players in the Market

- Alphabet Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Key Customers

- SWOT Analysis

Note (*): Similar analysis will be provided for other companies as well.

- com, Inc.

- ByteDance

- Meta Platforms

- Spotify AB

- Netflix Inc.

- Snap Inc.

- Pinterest, Inc.

- X Corp.

- Canva

- Roblox Corporation

- Etsy, Inc.

- Patreon, Inc.

- Discord Inc.

- Substack Inc.

- Other Major Players

Recent Developments

- In Nov 2025, Visa is announced a program with Karat Financial, a fintech startup that provides credit cards and banking tailored to content creators. They target emerging creators, offering advice and automated payment solutions. The effort also includes an AI agent that can assist in evaluating brand deal offers.

- In October 2024, Webfluential, the pioneering influencer marketing platform, announced the launch of an additional stable of products and services to empower content creators and reshape the digital marketing landscape. The expanded Webfluential platform introduces a suite of innovative products and services that cater to the evolving needs of content creators and brands alike Enhanced content creation and collaboration, Direct-to-audience sales, Stock content marketplace, Lead generation tools, and others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | US$ 210.80 Billion |

| Market Size in 2026 | US$ 275.30 Billion |

| Market Size by 2035 | US$ 3,043.00 Billion |

| Market Growth Rate from 2025 to 2035 | CAGR of 30.6% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2025 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Platform Type (Video streaming, Live Streaming, Blogging Platform, e-Commerce Platform, Pod-casting Platform, Others), By Creative Service (Arts & Crafts, Digital Content, Written Content, Video Production, Photography, Music Production, Others), By Revenue Channel (Advertising, Subscription, Tips/Donations, Affiliate Marketing, Selling Products/Merchandise, Brand Partnerships, Others), By End User (Armature Creator, Professional Creator) |

| Regional Analysis | North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC Countries, South Africa, North Africa, and Rest of MEA |