What is the Solar Photovoltaic (PV) Materials Market Size?

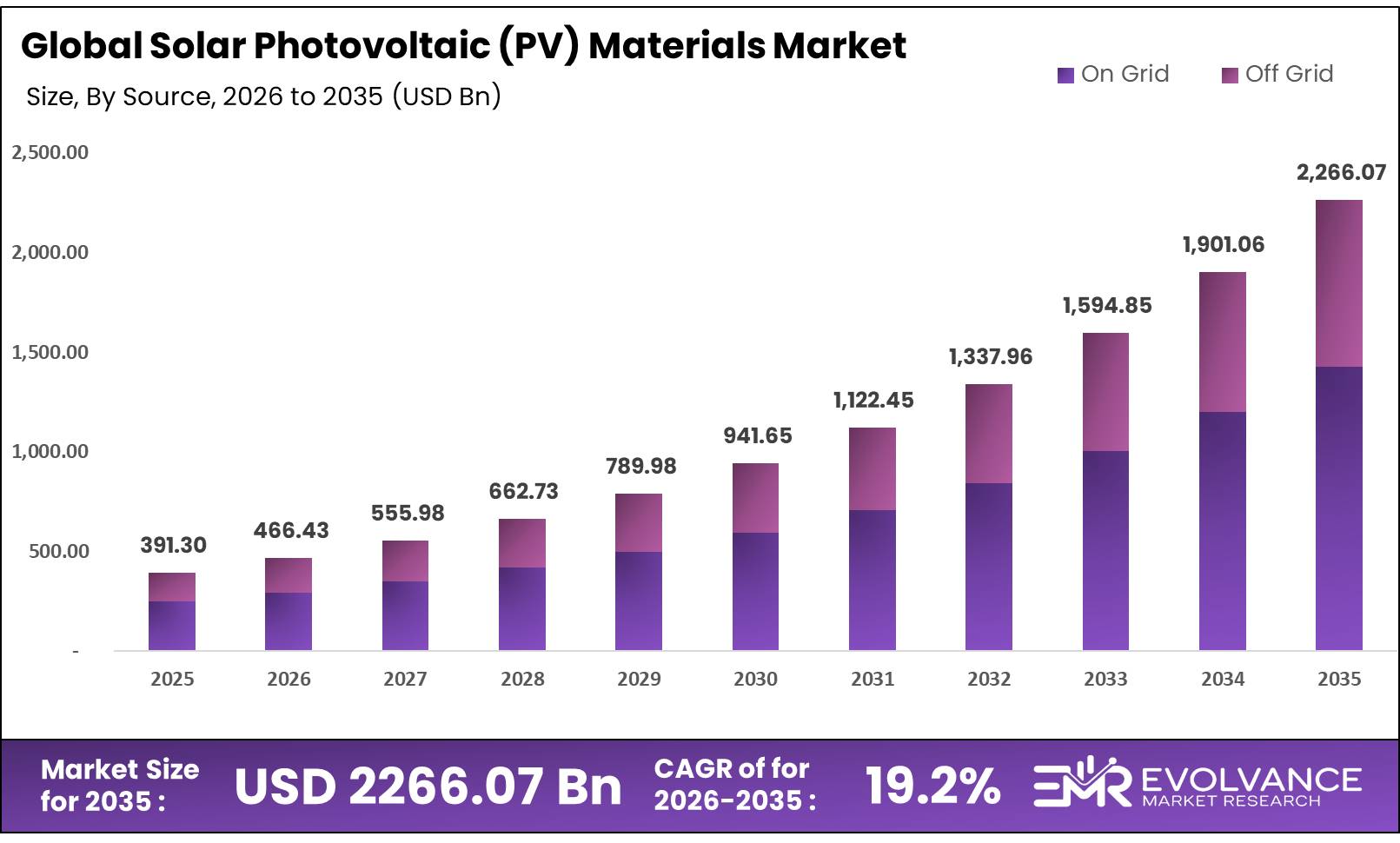

Global Solar Photovoltaic (PV) Materials Market size is expected to be worth around USD 2266.07 Billion by 2035 from USD 391.30 Billion in 2025, growing at a CAGR of 19.2% during the forecast period 2026 to 2035. This growth stems from rising global energy demand, falling costs of silicon and thin-film materials, and strong policy support for clean energy projects across developed and emerging markets.

Market Highlights

- The Global Solar Photovoltaic (PV) Materials Market is projected to surge from USD 391.30 Billion in 2025 to USD 2,266.07 Billion by 2035, registering a strong CAGR of 19.2% during 2026-2035 forecast period.

- Asia Pacific emerged as the dominant regional market with a 56.3% share in 2025, backed by strong government mandates and large manufacturing capacity.

- Silicon-based materials dominated the market in 2025 with a 67.3% share due to proven efficiency, cost competitiveness, and mature supply chains.

- On-grid solar systems led the connectivity segment with a 74.2% share, favored for grid integration, net metering, and stable revenue generation.

- Ground-mounted installations accounted for 65.3% of the market, driven by utility-scale solar farms seeking optimal energy output and easy maintenance.

- Utility end-use applications held a leading 59.3% share, supported by large-scale solar power projects and long-term power purchase agreements.

Market Overview

Solar photovoltaic materials form the core building blocks of solar panels that convert sunlight into electric power. These materials include silicon wafers, thin-film compounds, conductive pastes, encapsulation layers, and protective back sheets. Each component plays a vital role in panel efficiency, lifespan, and cost structure.

The market benefits from falling production costs and rising conversion efficiency rates. New cell designs and advanced materials help manufacturers deliver more power per panel at lower prices. This trend makes solar energy more competitive against fossil fuels and drives faster adoption worldwide.

Silicon remains the dominant material in the solar industry due to its proven reliability and cost advantages. Crystalline silicon accounts for about 95% of solar modules sold worldwide, delivering a strong balance of efficiency, durability, and affordability, with modules typically operating for 25 years or more while retaining over 80% of their original power output.

Emerging materials such as perovskites and multijunction cells show strong potential for future solar technologies. Perovskite cells have achieved lab efficiencies above 25%, while multijunction cells exceed 45% in specialized applications, but challenges related to stability, manufacturing complexity, and high costs currently limit their large-scale commercial adoption.

Manufacturing innovation drives material cost reduction and quality improvement. Automated production lines, better process controls, and economies of scale help suppliers cut prices while maintaining product standards. This virtuous cycle of lower costs and higher volumes attracts new players and expands total market capacity.

Supply chain development supports market growth in emerging regions. Local production of wafers, cells, and modules reduces import dependence and creates jobs. Countries invest in domestic PV material plants to capture value and secure energy independence through self-sufficient solar supply chains.

By Material Type Insights

Silicon-Based Materials dominates with 67.3% due to proven efficiency and cost advantages.

In 2025, Silicon-Based Materials held a dominant market position in the By Material Type segment of Solar Photovoltaic (PV) Materials Market, with a 67.3% share. Crystalline silicon delivers reliable performance at competitive prices, making it the preferred choice for utility, commercial, and residential solar projects worldwide. The material’s long track record and established supply chains reinforce its market leadership.

Thin-Film Materials serve niche applications where weight and flexibility matter more than peak efficiency. These materials work well in building-integrated systems and portable solar products. Lower manufacturing costs and simpler production processes help thin-film materials compete in price-sensitive market segments despite their relatively lower conversion efficiency.

Conductive and Encapsulation Materials protect solar cells and enable current flow within modules. Silver paste, copper ribbons, and polymer films form critical components that affect panel durability and output. Innovation in these materials focuses on reducing silver content while maintaining electrical performance to lower overall module costs.

Substrate and Back Sheet Materials provide structural support and weather protection for solar modules. Glass, polymers, and composite sheets shield cells from moisture, UV rays, and physical damage. Advanced back sheet designs extend module lifespan and reduce maintenance needs in harsh outdoor conditions.

By Connectivity Insights

On Grid dominates with 74.2% due to utility-scale project growth.

In 2025, On Grid held a dominant market position in the By Connectivity segment of Solar Photovoltaic (PV) Materials Market, with a 74.2% share. Grid-connected systems allow solar plants to feed power directly into national electricity networks, serving millions of homes and businesses. Large-scale solar farms and rooftop installations prefer grid connectivity for its operational simplicity and revenue potential through net metering and feed-in tariffs.

Off Grid systems provide power in remote areas without access to electric networks. These standalone installations use batteries to store energy for nighttime use and cloudy periods. Off-grid solar serves rural communities, telecom towers, and agricultural applications where grid extension costs exceed distributed generation investments.

By Mounting Type Insights

Ground Mounted dominates with 65.3% due to utility-scale project advantages.

In 2025, Ground Mounted held a dominant market position in the By Mounting Type segment of Solar Photovoltaic (PV) Materials Market, with a 65.3% share. Large solar farms use ground-mounted arrays to maximize land use and optimize panel orientation for peak energy capture. These systems offer easier installation, better cooling, and simpler maintenance compared to rooftop alternatives, making them ideal for utility-scale projects.

Roof Top installations make efficient use of existing building surfaces in urban and suburban areas. Commercial and residential properties adopt rooftop solar to reduce electricity bills and meet sustainability goals. Advances in mounting hardware and lightweight materials expand rooftop solar potential across different building types and roof designs.

By End Use Insights

Utility dominates with 59.3% due to large-scale solar farm deployment.

In 2025, Utility held a dominant market position in the By End Use segment of Solar Photovoltaic (PV) Materials Market, with a 59.3% share. Power companies and independent producers build massive solar plants to supply electricity to thousands of customers through the grid. These projects benefit from economies of scale, competitive power purchase agreements, and long-term revenue contracts that justify significant upfront investments in PV materials.

Residential Solar Power Systems help homeowners generate their own electricity and reduce monthly utility bills. Falling system prices and attractive financing options make residential solar accessible to middle-class families worldwide. Government rebates and net metering policies further improve project economics and accelerate adoption in suburban markets.

Commercial and Industrial Solar Installations offset energy costs for businesses and factories with high daytime power consumption. Warehouses, shopping centers, and manufacturing plants use rooftop and ground-mounted arrays to cut operating expenses. Corporate sustainability commitments and carbon reduction targets drive commercial solar investment across multiple industry sectors.

Other end uses include agricultural applications, water pumping, street lighting, and mobile power systems. These specialized markets value solar’s reliability and low maintenance requirements in off-grid settings. Innovative products like solar-powered irrigation pumps and portable charging stations create new demand for PV materials in emerging applications.

Market Segments Covered in the Report

By Material Type

- Silicon-Based Materials

- Thin-Film Materials

- Conductive and Encapsulation Materials

- Substrate and Back Sheet Materials

By Connectivity

- On Grid

- Off Grid

By Mounting Type

- Ground Mounted

- Roof Top

By End Use

- Utility

- Residential Solar Power Systems

- Commercial and Industrial Solar Installations

- Other

Solar Photovoltaic (PV) Materials Market Regional Insights

Asia Pacific Dominates the Solar Photovoltaic (PV) Materials Market with a Market Share of 56.3%, Valued at USD 220.4 Billion

Asia Pacific leads global PV materials demand with 56.3% market share, valued at USD 220.4 Billion in 2025. China, Japan, India, and Australia drive regional growth through massive solar farm projects and strong government clean energy mandates. The region hosts leading PV material manufacturers, benefits from low production costs, and enjoys robust supply chain networks that support rapid market expansion.

North America Solar Photovoltaic (PV) Materials Market Trends

North America shows strong growth in utility-scale solar and commercial rooftop installations. The United States and Canada invest heavily in renewable energy infrastructure to meet climate targets and reduce grid emissions. Federal tax credits, state-level renewable portfolio standards, and corporate sustainability programs fuel PV material demand across residential, commercial, and utility market segments.

Europe Solar Photovoltaic (PV) Materials Market Trends

Europe pursues aggressive carbon neutrality goals that boost solar deployment in Germany, France, Spain, and Italy. The region emphasizes high-efficiency materials, local manufacturing, and circular economy practices in PV production. Strong environmental regulations and feed-in tariff programs create stable long-term demand for advanced silicon-based and emerging thin-film materials.

Latin America Solar Photovoltaic (PV) Materials Market Trends

Latin America leverages abundant solar resources to expand renewable energy capacity in Brazil, Mexico, and Chile. Large-scale solar farms supply growing electricity demand while reducing fossil fuel dependence. Government auctions and private sector investment drive rapid market growth, creating opportunities for both imported and locally produced PV materials.

Middle East & Africa Solar Photovoltaic (PV) Materials Market Trends

Middle East and Africa regions develop solar capacity to diversify energy sources and support economic development. GCC countries and South Africa lead regional solar investments through utility-scale projects and industrial applications. High solar irradiance levels and falling technology costs make PV materials increasingly attractive for power generation in desert and semi-arid climates.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Regulatory Landscape

Global solar markets operate under various support programs and quality standards issued between 2024 and 2026. Many countries updated renewable energy targets, extended tax credits, and introduced new safety rules for PV materials and module manufacturing. These policies help stabilize market demand and encourage investment in advanced production capacity.

The European Union strengthened sustainability requirements for solar products through updated eco-design rules in 2024. These regulations mandate minimum efficiency levels, recyclability standards, and carbon footprint disclosures for PV materials sold in member states. Compliance drives innovation in green manufacturing and material recovery processes across the global supply chain.

United States federal agencies maintain strict quality and safety standards for grid-connected solar systems. The Inflation Reduction Act of 2022, with extensions through 2026, provides production tax credits for domestic PV material manufacturing. These incentives aim to rebuild American solar supply chains and reduce dependence on imported components.

China implements national standards for PV material quality, performance testing, and environmental protection. Recent updates in 2025 raised minimum efficiency requirements and banned certain hazardous substances in solar cell production. These regulations push manufacturers toward cleaner processes and higher-quality outputs that meet international market expectations.

Drivers

Accelerating Global Renewable Energy Capacity Additions and Net-Zero Commitments Drive Market Growth

Countries worldwide commit to carbon neutrality targets that require massive solar capacity additions over the next decade. National climate plans and international agreements create strong long-term demand for PV materials across all market segments. Governments prioritize solar energy as a proven, scalable solution to reduce greenhouse gas emissions from power generation.

Falling solar costs make PV materials competitive with conventional energy sources in most markets. Improved manufacturing efficiency and technology advances lower the price of silicon wafers, cells, and modules year after year. This cost decline expands solar’s addressable market and enables projects that were previously uneconomical to move forward.

Rising electricity consumption from data centers, electric vehicles, and industrial growth creates new demand for clean power. Solar energy provides distributed generation capacity that can be deployed quickly near load centers. PV material suppliers benefit from this structural shift toward electrification and digital infrastructure investment worldwide.

Restraints

Volatility in Raw Material Prices Including Polysilicon, Silver Paste, and Specialty Chemicals Limits Market Stability

Sharp price swings in polysilicon and other key inputs create planning challenges for PV material producers. Supply shortages or demand surges can double or triple raw material costs within months, squeezing profit margins. Manufacturers struggle to pass these costs to customers in competitive bidding environments for large solar projects.

High capital costs for advanced production facilities limit market entry and expansion by smaller players. Building a polysilicon plant or wafer fabrication line requires hundreds of millions in upfront investment before generating revenue. This financial barrier concentrates production among established firms and slows overall capacity growth during demand spikes.

Performance degradation of PV materials over time raises concerns about long-term value and recycling costs. Modules lose efficiency gradually, and end-of-life disposal creates environmental challenges without proper recovery systems. Limited recycling infrastructure for solar materials adds to total ownership costs and complicates sustainability claims for the industry.

Growth Factors

Commercialization of High-Efficiency Materials such as Perovskites and Tandem Solar Cells Accelerates Market Expansion

Research labs and startup companies race to bring next-generation PV materials from bench to market. Perovskite and tandem cell designs promise efficiency gains above 30%, far exceeding today’s standard silicon modules. Successful commercialization of these materials would unlock new applications and drive replacement cycles in existing solar installations.

Building-integrated photovoltaics and solar mobility applications demand lightweight, flexible PV materials that traditional silicon cannot provide. Thin-film technologies and organic solar cells serve these emerging markets with products that conform to curved surfaces. Growing interest in solar windows, vehicle roofs, and portable devices expands total addressable market beyond conventional panel installations.

Countries invest in domestic PV material production to secure supply chains and capture economic value. Trade policies, local content requirements, and manufacturing subsidies encourage regional production capacity. This reshoring trend creates opportunities for equipment suppliers, raw material producers, and integrated manufacturers in markets previously dominated by imports.

Emerging Trends

Shift Toward N-Type Silicon Wafers and Advanced Cell Architectures Reshapes Market Landscape

Solar manufacturers adopt N-type silicon wafers and advanced cell designs like TOPCon and HJT for better efficiency. These technologies reduce power losses and improve performance in hot climates and low-light conditions. The transition requires new production equipment and modified material specifications that create opportunities for innovative suppliers.

Companies develop silver-free or low-silver conductive materials to cut costs and reduce supply risk. Silver prices and availability constraints push research into alternative metals like copper and conductive polymers. Successful substitution would lower module costs significantly and eliminate dependence on a scarce precious metal.

Green manufacturing practices and low-carbon PV materials gain importance as buyers scrutinize supply chain emissions. Solar producers invest in renewable energy for their factories and source low-carbon polysilicon and aluminum. This trend toward sustainable production creates premium segments and competitive advantages for environmentally responsible material suppliers.

Solar Photovoltaic (PV) Materials Market Key Companies Insights

Wacker Chemie AG supplies high-purity polysilicon for solar cell production through advanced chemical processing technology. The company operates large-scale plants in Germany and the United States, serving global PV manufacturers with reliable material quality. Wacker invests in capacity expansion and process efficiency to maintain its competitive position in the growing silicon market.

DuPont provides advanced polymer films, encapsulation materials, and conductive pastes for solar module assembly. The company leverages materials science expertise to develop products that improve module reliability and lifespan. DuPont collaborates with panel manufacturers to optimize material combinations for new cell architectures and demanding environmental conditions.

First Solar specializes in thin-film cadmium telluride solar modules and operates integrated manufacturing facilities. The company controls its entire supply chain from material sourcing through module production and recycling. First Solar’s technology offers advantages in hot climates and maintains strong utility-scale project presence in North America and international markets.

Jinko Solar ranks among the world’s largest producers of solar cells, modules, and silicon wafers. The company builds vertically integrated manufacturing capacity to control costs and ensure quality across the PV material value chain. Jinko Solar supplies residential, commercial, and utility projects globally while expanding production in multiple countries.

Key Companies

- Wacker Chemie AG

- DuPont

- Mitsubishi Materials Corporation

- Honeywell International Inc

- COVEME S.p.A.

- Jinko Solar

- Corporation

- RENESOLA

- KYOCERA

- JA SOLAR Technology Co., Ltd.

- First Solar

- Wuxi Suntech Power Co., Ltd.

- Canadian Solar

- Trinasolar

- Hanwha Group

- REC Solar, Inc

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

Recent Development

- January 2025 – Jinko Solar launched new N-type TOPCon solar cells with conversion efficiency exceeding 25.5% for mass production. The company invested over USD 500 Million in new manufacturing lines to support growing demand for high-efficiency modules in global markets.

- December 2024 – Canadian Solar expanded polysilicon production capacity by 40,000 metric tons annually through a new facility in Southeast Asia. This investment strengthens vertical integration and reduces supply chain risks for the company’s cell and module operations.

- November 2024 – First Solar announced plans to build a 3.5 GW thin-film module factory in the United States. The project will create over 850 jobs and support domestic solar manufacturing through federal Inflation Reduction Act incentives.

- October 2024 – DuPont introduced a new low-carbon encapsulation material that reduces module manufacturing emissions by 30% compared to standard products. This innovation addresses growing customer demand for sustainable PV materials with lower environmental footprints.

- September 2024 – Wacker Chemie AG completed expansion of its polysilicon production in Tennessee, adding 20,000 metric tons of annual capacity. The upgrade supports rising demand from North American solar manufacturers seeking local material sources.

- August 2024 – Trinasolar achieved a new world record with 26.1% conversion efficiency for industrial-size silicon solar cells. The breakthrough demonstrates ongoing innovation in material quality and cell design for next-generation solar modules.

Market Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 391.30 Billion |

| Forecast Revenue (2035) | USD 2266.07 Billion |

| CAGR (2026-2035) | 19.2% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

| Segments Covered | By Material Type (Silicon-Based Materials, Thin-Film Materials, Conductive and Encapsulation Materials, Substrate and Back Sheet Materials), By Connectivity (On Grid, Off Grid), By Mounting Type (Ground Mounted, Roof Top), By End Use (Utility, Residential Solar Power Systems, Commercial and Industrial Solar Installations, Other) |

| Regional Analysis | North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) |

| Competitive Landscape | Wacker Chemie AG, DuPont, Mitsubishi Materials Corporation, Honeywell International Inc, COVEME S.p.A., Jinko Solar, Corporation, RENESOLA, KYOCERA, JA SOLAR Technology Co., Ltd., First Solar, Wuxi Suntech Power Co., Ltd., Canadian Solar, Trinasolar, Hanwha Group, REC Solar, Inc, HANGZHOU FIRST APPLIED MATERIAL CO., LTD. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Purchase Options | We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |